Assemblywoman Galef/Senator Serino Applaud Cuomo for Signing Bill to Make it Easier for Seniors to get Property Tax Breaks

November 24, 2015

-

COMMITTEE:

- Aging

Assemblywoman Galef/Senator Serino Applaud Cuomo for Signing Bill to Make it Easier for Seniors to get Property Tax Breaks

New Legislation Requires Tax Assessors to Ease Process for

Seniors to Participate in Enhanced STAR

Assemblywoman Sandy Galef (Ossining) and Senator Susan Serino (Hyde Park) today applauded Governor Andrew Cuomo for signing legislation they sponsored (A7375/S5446) to amend real property tax law, and require that all assessing units must participate in the Enhanced School Tax Relief exemption (STAR) Income Verification Program-Chapter 451 of the Laws of New York State.

Enhanced STAR provides an increased benefit for the primary residences of senior citizens (age 65 or older) with qualifying incomes. These participants are exempt from the first $65,300 of the full value of a home from school taxes as of 2015-2016 school tax bills (up from $64,200 in 2014-15). The Income Verification Program allows seniors who are re-applying for Enhanced STAR to authorize their assessor to have their incomes verified in following years by the NYS Department of Taxation and Finance (DTF). Because seniors do not need to re-apply as long as their income-eligibility is verified annually, the program streamlines the process for both seniors and assessors.

This legislation is considered important for all Enhanced STAR participants who have previously missed the annual application process. In former years, some tax assessors have not given the income verification program as an option to taxpayers. This amendment will require that all assessing units participate in STAR Income Verification Program.

“This new law is extremely important for Enhanced STAR recipients who have missed the program in past years” said Assemblywoman Sandy Galef. “It is important that tax assessors make sure that all interested seniors be included in this program. We have seen that assessors are not consistently offering the STAR Income Verification Program, so this amendment makes it mandatory that this program be offered.”

Senator Susan Serino said “Our seniors have worked incredibly hard to build the communities we know and love and they deserve the opportunity to enjoy their golden years to the fullest. With so many seniors living on fixed incomes, this measure will relieve the burden of having to re-apply for Enhanced STAR annually and go a long way in ensuring that our seniors receive the property tax relief they deserve.”

Share this Article or Press Release

Newsroom

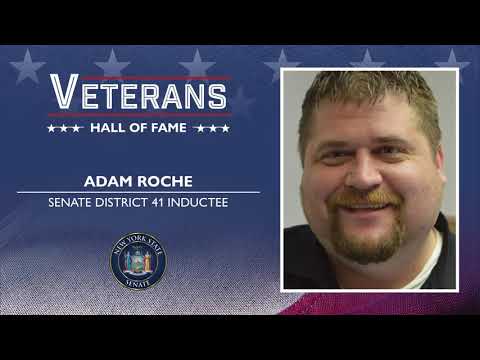

Go to NewsroomAdam Roche

November 11, 2020

SERINO SECURES FUNDING FOR LOCAL REMOTE LEARNING PROGRAM

November 2, 2020