Larkin Veterans’ Buyback Bill Passes Senate

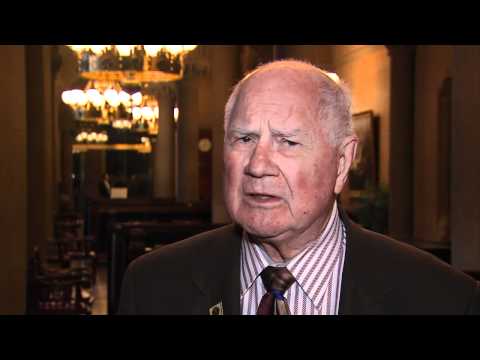

William J. Larkin Jr.

May 27, 2015

-

ISSUE:

- Veterans

Albany, NY - Senator Bill Larkin (R, C – Cornwall-On-Hudson) announced today that Senate Bill S4124 passed the Senate unanimously. This legislation will allow all honorably discharged veterans who are members of a Public Employee Retirement System within New York State to purchase up to three years of service credit for time served in the military.

“Regardless of where and when they served, all of our veterans are owed a debt of gratitude,” said Senator Bill Larkin. “This bill will ensure that every honorably discharged veteran who is currently in a Public Employee Retirement System be allowed to purchase up to three years of their service in the military. Previously, each veteran had to have served in specific periods of war in order to buy back their time and this legislation will correct this inequity.”

Senate Bill S4124, also known as the Veterans’ Buyback Bill, includes an appropriation from the State to ensure that this action is not an unfunded mandate and a burden to local municipalities.

Last year, a similar bill was vetoed by Governor Cuomo close to Veteran’s Day. In his veto message the Governor stated his preference for this proposal to be considered in the broader context of the State Budget negotiations. While the Senate did include funding in its one house budget for this proposal, unfortunately the funding was not included in the final adopted budget.

“I believe with this bill we have addressed the Governor’s concerns and will bring all veterans one step closer to being able to purchase their time in the military. I implore the Assembly and the Governor to do what is right for those who have fought for us and continue to fight for us every day by ensuring this legislation becomes law,” said Larkin.

This legislation has been sent to the Assembly for action.

Share this Article or Press Release

Newsroom

Go to NewsroomJobs Resource Center

January 12, 2012

New York State Senate Mourns the Late Assemblyman Tom Kirwan

January 10, 2012