SENATOR BRAD HOYLMAN ANNOUNCES LEGISLATION REQUIRING THE RELEASE OF PRESIDENTIAL CANDIDATES’ TAX RETURNS AS A QUALIFICATION FOR THE BALLOT IN NEW YORK

December 6, 2016

Hoylman: For over four decades, tax returns have given voters an important window into the financial holdings and potential conflicts-of-interest of presidential candidates. Voters deserve to know that personal priorities will never take precedence over the national interest.”

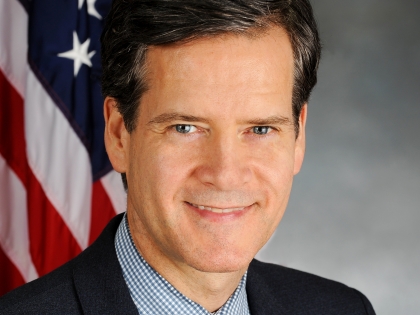

NEW YORK – State Senator Brad Hoylman (D, WFP-Manhattan) announced legislation today that would require presidential candidates to submit their most recent five years' worth of tax returns to the New York State Board of Elections (BOE) in order to appear on the ballot in New York State.

Under the provisions of the Tax Returns Uniformly Made Public (T.R.U.M.P.) Act, any candidate for President or Vice President who wants to appear on the New York ballot would be required to file at least five years’ worth of their federal income tax returns with the BOE no later than 50 days prior to the general election. Upon receipt of returns the BOE would have 10 days to redact personal information and make them publicly available on the BOE website.

Failure to comply with the law would disqualify a candidate from appearing on the general election ballot and prohibit New York’s representatives in the Electoral College from casting a vote for them.

State Senator Brad Hoylman said: “For over four decades, tax returns have given voters an important window into the financial holdings and potential conflicts-of-interest of presidential candidates. Sadly, President-elect Donald Trump repeatedly refused to release copies of his federal income taxes prior to the election, denying voters this crucial information. This isn’t normal. Voters deserve to know that personal priorities will never take precedence over the national interest. In response, New York should take corrective action and make the provision of tax returns a qualification to appear on the ballot for President of the United States. And I hope other state legislatures will follow New York’s lead and introduce their own version of the T.R.U.M.P. Act.”

Because presidents are exempt from most federal conflicts-of-interest laws, tax information – along with legally required financial disclosure forms – provide voters their only opportunity to view candidates’ financial standings including yearly income and debts, list of investments, tax rate paid, loopholes utilized, amount given to charity, as well as a list of business connections and interests. It is also something voters want. A CNN/ORC poll of registered voters taken in October found that 73% thought Donald Trump should release his tax returns for public review.

Hoylman continued: “The practice of releasing tax returns has been standard practice for the simple reason that American presidential candidates should be held to a higher standard of transparency. When long standing democratic norms are threatened, it becomes necessary to codify them into law. That’s the purpose of the T.R.U.M.P. Act.”

Share this Article or Press Release

Newsroom

Go to NewsroomLetter to Speaker Adams on Protecting our Environment and the CACP

September 17, 2024

Proposal 1: Equal Rights Amendment

September 10, 2024

Expanding the Free Student OMNY Program

September 9, 2024

Letter to X Rejecting Their Meeting Request

September 9, 2024