Sanders Hosts Debt Relief Info Session

May 19, 2016

State Senator James Sanders Jr. (D-Rochdale Village) held a free financial information session yesterday at the Jamaica Chamber of Commerce called “Debt 101,” where experts educated the community on how to break free from the burden of owing money.

“Millions of Americans struggle with debt,” Sanders said. “It can lower your credit score, strain your monthly budget and even affect your mental health. The path to eliminating one’s debt may seem overwhelming, but we are here tonight to show you how to take those all important first steps to achieving financial freedom.”

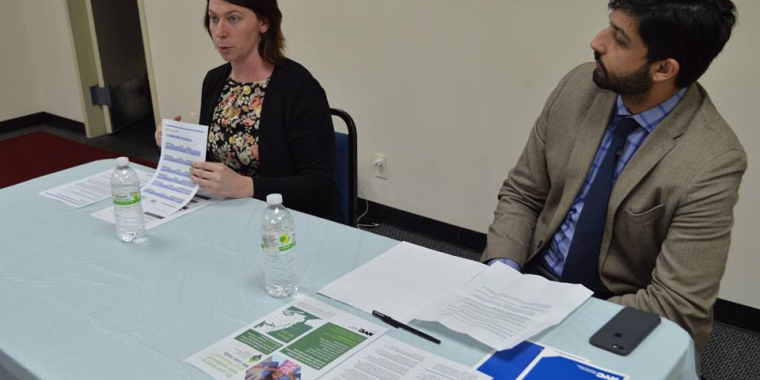

The panelists were Alyssa Keil, Senior Financial Coach with the Financial Clinic, and Steven Ettannani, Senior Advisor of State and Federal Policy with the NYC Department of Consumer Affairs. They discussed a number of topics including how to manage student loan debt, tips for negotiating with debt collectors, improving one’s credit score, creating a budget, opening a bank account, saving and planning for the future, and much more.

Alyssa Keil, Senior Financial Coach with the Financial Clinic, explained that there are two kinds of debt – revolving and installment. Revolving debt usually applies to credit cards, where you have a limit, and every time you pay it off, you max it out again. Installment debt typically relates to homes or mortgages. It starts out high but gets lower as payments are made.

There are two primary ways to pay off debt – the snowflake method and the snowball method. The snowflake plan is where you try to pay off the smallest debts first so that over time you are consolidating the number of payments you have to make per month. The snowball plan is where you take the debt that is going to cost you the most in interest over time and work on paying that down the fastest.

When beginning to tackle your overall debt, Keil advised examining your three-bureau credit report (Experian, TransUnion, Equifax), then filling out a debt management budget sheet, which she distributed, in order to prioritize which debts need to be paid first. Factors in determining this would include whether an account is past due or an asset is at stake.

Next, Keil told attendees to take two weeks to track their general household and personal expenses to determine whether they are operating at a surplus or a deficit. In the case of the former, extra money could be used to pay off the most urgent debts, and in the case of the latter, the individuals may have to continue making minimum payments until either their income increases or they can find areas in their budget where they can cut back.

Keil offered some tips on what to avoid when it comes to credit cards. Taking cash advances are unwise, she said, because they have very high interest rates, which begin immediately, as opposed to giving you 30 days to pay off what you owe, as is the case with a standard credit card charge purchase. There is often a flat fee associated with cash advances as well. Also, avoid making just the minimum payment on a credit card, Keil said, because it will take longer to pay off the debt and more interest will accrue.

Steven Ettannani, Senior Advisor of State and Federal Policy with NYC Department of Consumer Affairs, explained that the agency does more than field complaints about businesses. It also houses an Office of Financial Empowerment, which is the first government program in the nation expressly aimed at empowering the city’s most vulnerable populations. It has published a debt collection guide, which Ettannani handed out at the meeting, that outlines a person’s rights under city, state and federal law, and features tips on how to pay off credit card and student loan debt. The DCA also has a number of financial empowerment centers across the city where people can receive free and confidential financial counseling on a number of debt-related issues.

“We do not use the term empowerment lightly,” Ettannani said. “This is about uplifting folks and giving them the tools, so that they can succeed.”