Addabbo Joins Senate in Passing Bills to Assist Veterans

May 4, 2016

-

ISSUE:

- Veterans

Howard Beach, NY (May 4, 2016) NYS Senator Joseph P. Addabbo, Jr. has joined with his Senate colleagues in recent weeks to approve a variety of proposals aimed at cutting taxes and transportation costs for New York’s former servicemen and women, improving their health care options and ensuring that all veterans – including those of the four-legged variety – are afforded the respect and dignity their military service deserves.

“Throughout the years, and over the course of many conflicts around the globe, our servicemen and women have given of themselves and have frequently put their own lives on hold, and on the line to protect and preserve our way of life,” said Addabbo, who serves as the ranking member of the Senate Committee on Veterans, Homeland Security and Military Affairs. “Whether they saw combat, served in medical or technological capacities, provided mechanical expertise or otherwise helped in any variety of ways to keep our military strong and our country safe, we owe our veterans a tremendous debt of gratitude every single day.”

A package of legislation approved by the Senate with Addabbo’s support in recent weeks seeks to provide disabled veterans with tax breaks, offer former servicemen and women breaks on transit costs and help to ensure that veterans are able to access and receive effective health care. The bills also propose to honor canine military members, ensure that unclaimed cremated remains of veterans are treated with dignity and punish those who impersonate members of the military for personal gain.

Specifically, the bills are as follows:

S.3549, co-sponsored by Addabbo, would enable veterans’ organizations to receive, bury and otherwise respectfully dispose of the cremated remains of former servicemen and women that have not been claimed by their families. In some cases, these remains may remain abandoned for decades in funeral homes, crematoriums, prisons, hospitals and other facilities without a final resting place.

S.5201 would create the crime of stolen valor, punishable by a $250 fine, to be imposed upon persons who, for purposes of personal monetary gain or benefits, impersonate members of the armed forces or reserves through their dress and insignia, or claim to be acting upon the authority and approval of the military. The fees would be directed to New York State’s veterans’ remembrance and cemetery maintenance and operation fund.

S.3826 would designate March 13th of every year as K9 Veterans Day in honor of dogs who have served in the military and have at times given their own lives as four-legged members of the armed forces – patrolling borders, protecting soldiers, aiding the Secret Service and otherwise contributing to national and international security. The official K9 Corps was created on March 13, 1942 by Joseph J. White, a retired military working dog handler.

S.3137 would require the New York State Division of Veterans Affairs to provide information on its website about veterans integrated service networks and otherwise offer a health care fact sheet for former members of the armed forces to help them better access medical services. The bill would also require hospitals to ask patients about their veteran status and provide health care fact sheets to those identified as having served in the United States military.

S.877 would establish a Veterans’ Gerontological Advisory Committee in the New York State Office for the Aging to better care for the needs of elderly former members of the military. The 19-member panel must have 10 members who are veterans, and at least 60 percent of the membership must be 60 years of age or older. Appointments to the Committee would be made by the Governor, Legislature, and Office for the Aging.

S.5545 would create a half-fare rate program for veterans in the Metropolitan Transportation Authority to provide transportation savings to honorably discharged former members of the military who live in New York State. Veterans taking advantage of the reduced fares would be required to display an authorized veteran identification card.

S.4627 would revise the existing alternative property tax exemption program for veterans to provide a 100 percent exemption to veterans who are 100 percent disabled as a result of their military service and their unmarried surviving spouses. Eligible veterans would need to have served in a combat theatre or zone of operations and received certain United States campaign ribbons, service medals and expeditionary medals.

All of these proposals, now that they have been approved by the State Senate, are under review by several different committees in the State Assembly.

Share this Article or Press Release

Newsroom

Go to Newsroom

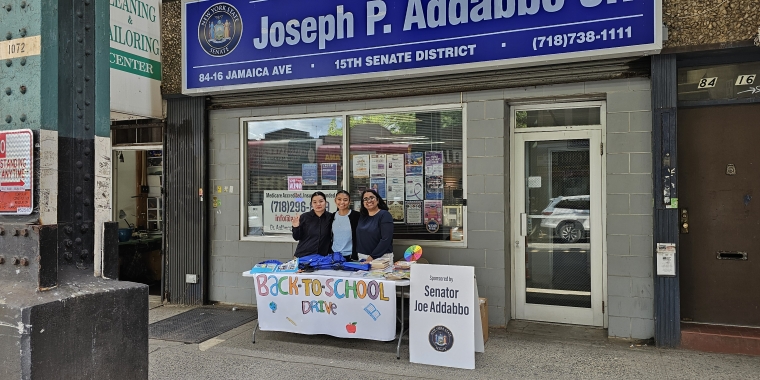

Addabbo Interns Host Pop Up School Supply Giveaway

September 5, 2024

Addabbo Hosts Annual Concert to Honor Band Leader Arnie Mig

September 5, 2024