Westchester County's State Delegation Signs on to STAR Rebate Reform Bill

March 23, 2017

Westchester County, NY – The members of Westchester County’s Democratic state delegation have co-sponsored legislation in both the Senate and the Assembly (A5969/S4733) that would sunset changes made in 2016 to the School Tax Relief Program, or STAR rebate exemption process, and restore the program to the way it functioned in earlier years.

The previous version of the STAR Exemption program immediately reduced a property owner’s tax liability by providing relief for a property owner’s tax burden upfront. In the current iteration of the program, the State instead sends a reimbursement check to property owners after they have already paid their school tax bills. Many taxpayers have considered this process burdensome – particularly people with lower incomes, who have encountered difficulty paying their full school tax bills and have had to wait, often for months, for reimbursements checks to arrive.

The STAR program was modified last year to shift the responsibility of providing tax relief from local governments to the State Department of Taxation and Finance. This reform has put a burden on many taxpayers, since the system has been riddled with significant glitches that have delayed the delivery of reimbursement checks, often for many months, and, in some instances, for over a year. These glitches have also caused errors that produce checks made out to the wrong people or sent to the wrong addresses.

This new bill would repeal the controversial changes made to the STAR Program and facilitate the timely adoption of the earlier version of the program, which provided eligible taxpayers with an immediate property tax exemption, rather than a reimbursement check.

Households that earn an annual income under $500,000 are eligible for the basic STAR program and receive exemptions from the first $30,000 of the complete value of their homes from school taxes. Property owners 65 years and older with an income of $86,000 or less are also eligible for Enhanced STAR, which grants them a greater degree of tax relief.

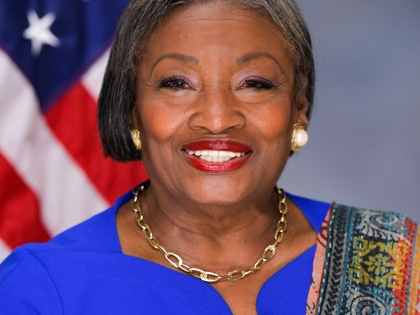

“The STAR Program provides significant tax relief for working families, and it should work in a way that helps taxpayers,” said State Senator and Senate Democratic Leader Andrea Stewart-Cousins. “The new system inconveniences too many people, and everyone would be better served if it were restored to its previous, functional form.”

"It is imperative that we do everything we can to effectively reduce high property taxes,” said State Senator George Latimer. “The Star Program has been very effective, and unfortunately, the implementation of the changes to it have weakened its ability to properly serve people across the state. We need to fix it and make it work again for our property tax payers.”

“The changes to the STAR program have been a failure,” said Assemblywoman Sandy Galef, who authored the Assembly version of the bill. “We had concerns about distributing checks for the STAR amount when the idea was first presented. My office has received call after call asking where the checks are and why they did not arrive when they were expected, leading to people having to put forward the money for this year’s taxes before receiving the credit from last year. This puts an undue burden on taxpayers, and is unacceptable. Without reverting back to our previous system, there is no promise that the same situation will not play out again in the coming year as more property owners are included.”

“I'm pleased to have co-sponsored this bill which will, when passed by the Senate and signed by the Governor, address some of the unnecessary complications to the STAR program for new homeowners,” said Assemblywoman Shelley Mayer. “We need to make the STAR program work effectively, as it did in the past, so that new buyers who are eligible for this tax benefit can receive it directly as a reduction of tax liability, rather than waiting for a refund check."

“From its onset, the Star Program has always been a critical asset to hard working homeowners and we must do all that we can to ensure that the process remains simplified and therefore keep more of our taxpayers money in their pockets,” said Assemblyman Gary Pretlow.

“The STAR program once provided reliable and meaningful property tax relief for New York homeowners -- and it needs to do so again,” said Assemblyman David Buchwald. “The changes to STAR have eroded its effectiveness for hard working families. I stand with my fellow legislators in pushing for the STAR program to be returned to functionality.”

“I have been opposed to the changes to the STAR program from the onset,” said Assemblywoman Amy Paulin (D-88) said. “The changes made last year have caused financial chaos for my constituents who have been waiting months to be reimbursed by the state for property tax relief which they are entitled to by law. Taxpayers have an obligation to pay their taxes on time or be penalized. The state has not lived up to its obligation to get them their checks before they have had to pay their school taxes. This will only get worse as more people are added to the rolls."

“The STAR program should be fairly administered and reduce the homeowner’s tax liability before the homeowner needs to pay the school tax bill,” said Assemblyman Thomas Abinanti. “This bill will reinstate the former way of administering the process, which worked well before the Governor required unwise changes last year.”

Share this Article or Press Release

Newsroom

Go to NewsroomSenate Majority Helps Small Businesses Build Back From COVID-19

January 19, 2021

Honoring Rev. Dr. Martin Luther King Jr.

January 18, 2021