HOYLMAN & BUCHWALD TO NEW YORK: RELEASE TRUMP’S STATE TAX RETURNS

April 27, 2017

-

ISSUE:

- Donald Trump

Hoylman: If lawmakers in Washington won’t force President Trump to release his tax returns, lawmakers in Albany should do it instead. New Yorkers deserve to know if statewide officials – including Trump – pay their fair share of taxes.”Hoylman: “If lawmakers in Washington won’t force President Trump to release his tax returns, lawmakers in Albany should do it instead. New Yorkers deserve to know if statewide officials – including Trump – pay their fair share of taxes.”

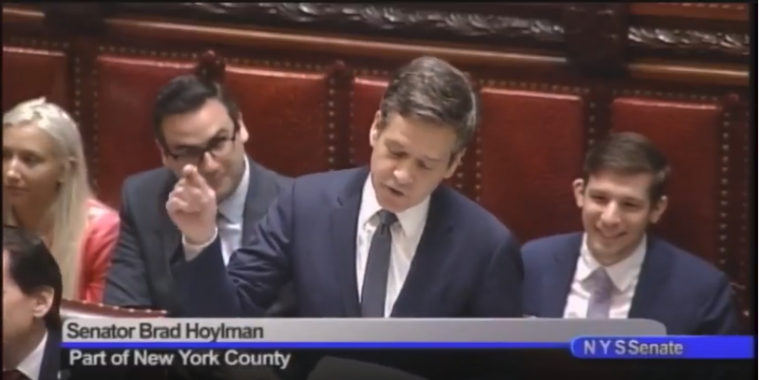

Albany – State Senator Brad Hoylman (D, WFP – Manhattan) and Assemblymember David Buchwald (D, WFP – Westchester) announced the introduction of legislation that would require the New York State Department of Taxation and Finance (NYSDTF) to release income tax information and returns for statewide elected officials, including the President of the United States. This legislation is the only one of its kind in the nation.

The bill would require the most recent five years of tax returns be posted to the NYSDTF’s website within 30 days of enactment of the bill, and in the future within 30 days of when the elected officials take the oath of office. Future tax returns would be posted within 30 days after they have been filed with NYSDTF, until the elected officials leave office. Other statewide elected officials affected by this legislation include the Vice President of the United States, the U.S. Senators representing New York, along with the Governor, Lieutenant Governor, Attorney General and State Comptroller. The legislation instructs NYSDTF to redact social security numbers and other personal information the disclosure of which would violate federal law.

“If lawmakers in Washington won’t force President Trump to release his tax returns, lawmakers in Albany should do it instead,” said State Senator Brad Hoylman. “We have a unique opportunity to advance the cause of presidential tax transparency. New Yorkers deserve to know if statewide officials – including Trump – pay their fair share of their taxes and avoid conflicts of interest.”

“Now is the time for legislative action to ensure the transparency of high ranking elected officials’ tax returns,” said Assemblyman David Buchwald. “This bill recognizes that a personal interest in secrecy can be outweighed by the public’s right to know the tax and financial interests of its top government leaders.”

Senator Daniel Squadron said: "Presidential candidates release their tax returns so the American people know they are focused on job number one -- serving the country in a role with extraordinary power. Donald Trump's refusal speaks volumes about his values, but does not give the public or the press the most important information about his conflicts and incentives. New York can solve that," said State Senator Daniel Squadron. "Thank you to Senator Hoylman and Assemblymember Buchwald, professor Daniel Hemel, and the many Americans pushing for good government."

Susan Lerner, Executive Director of Common Cause NY, said: "Every presidential candidate since Richard Nixon has released his or her tax returns, except Donald Trump,” said Susan Lerner, Executive Director of Common Cause New York. “Americans have the right to know if the President is putting his business empire, or the interests of the public, first. We commend Senator Hoylman and Assemblyman Buchwald for introducing a common sense solution to the problem that brought out tens of thousands of New Yorkers for Tax March.”

The overwhelming majority of Americans—80%, according to one recent survey—say the president should release his returns. But thus far Trump has rebuffed those demands, and in Washington House leaders won’t even allow a vote on a bipartisan bill that would require the returns to be released.

Governor Cuomo, Senator Schumer, and Senator Gillibrand have already posted their returns online.

Share this Article or Press Release

Newsroom

Go to NewsroomStranded at the Altar: 2018 Update

June 24, 2018

State Senate Dems say LGBT bills routinely killed

June 24, 2018