HOYLMAN FORCES NY STATE SENATE VOTE ON TRUMP’S TAXES

March 10, 2017

Hoylman: New York has the responsibility to ensure that voters know if presidential candidates have potential conflicts of interest before they cast their ballot.”

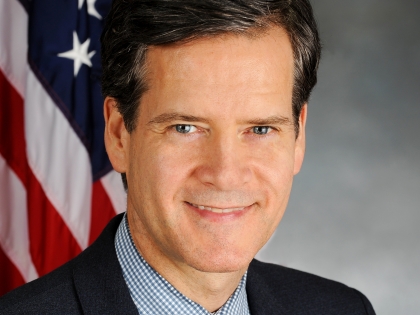

ALBANY – State Senator Brad Hoylman (D, WF-Manhattan) introduced a Motion for Committee Consideration on his legislation to require presidential candidates to release five years of tax returns as a condition for appearing on the ballot in New York. The Motion is a parliamentary maneuver that forces the Senate Elections Committee, chaired by Republicans, to allow an up or down vote on legislation.

Hoylman’s Tax Returns Uniformly Made Public (T.R.U.M.P.) Act would require any candidate for President or Vice President who wants to appear on the New York ballot to file the most recent five years of their federal income tax returns with the NYS Board of Elections (BOE) no later than 50 days prior to the general election. The BOE would then have 10 days to make them publicly available on its website. Failure to comply would disqualify a candidate from appearing on the general election ballot.

State Senator Brad Hoylman said: “Until last year, the release of presidential candidates’ tax returns was a tradition going back 40 years. In light of recent revelations, it’s more important than ever for Americans to see what may be hiding in a presidential candidate’s tax returns. New York has the responsibility to ensure that voters know if presidential candidates have potential conflicts of interest before they cast their ballot. ”

Since Hoylman first announced the T.R.U.M.P. Act back in December, the bill has been endorsed by the New York Times Editorial Board; a change.org petition calling for passage of the bill has garnered more than 138,000 signatures; and legislators in 21 states have committed to, or announced interest in, introducing a version of the legislation. The coalition of T.R.U.M.P. Act states represents more than 129 million voters – more than a third of the entire population of the United States – and 271 electoral votes, one more than the number needed to win the presidency.

A national poll released two weeks ago by Public Policy Polling showed 58 percent of voters want Donald Trump to release his tax returns, while 53 percent expressed support for a law requiring candidates for President to release five years of their tax returns in order to appear on the ballot.

According to a Washington Post/ABC News poll released in January, 74 percent of Americans believe Donald Trump should release his tax returns.

Share this Article or Press Release

Newsroom

Go to NewsroomMy Efforts to Close the Wage Gap

April 10, 2018

My Statement on Pfizer's Grant to Hudson Guild

April 10, 2018

Adopted Budget for Fiscal Year 2018 - 2019

April 6, 2018