IT’S BLEAKER ON BLEECKER STREET: NEW REPORT EXAMINES HIGH-RENT BLIGHT IN GREENWICH VILLAGE & CHELSEA

May 24, 2017

Hoylman: Bleecker Street is a cautionary tale of how high rents in the Village and Chelsea are pushing out longtime independent business. We can’t simply allow market forces to run roughshod over our community any longer."

NEW YORK – State Senator Brad Hoylman (D, WF-Manhattan) released the findings of a new report examining the growing specter of vacant storefronts throughout Manhattan. Combining on-the-ground data collection with firsthand accounts from small businesses, Bleaker on Bleecker: A Snapshot of High-Rent Blight in Greenwich Village and Chelsea looks at the causes and impacts of storefront vacancies and recommends solutions to address the problem.

Using data collected through multiple surveys across major commercial hubs in Senator Hoylman’s district, the report finds elevated vacancy rates, including sky-high rates along the Bleecker Street business corridor:

- 18.4% vacancy rate along Bleecker Street from 6th to 8th Avenues

- 9.8% overall vacancy rate along First Avenue from 10th to 23rd Streets, Second Avenue from 3rd to 14th Streets, Eighth Avenue from 15th to 22nd Streets, and Bleecker Street from 6th to 8th Avenues

Speaking with local business owners, Senator Hoylman’s office found numerous examples of high rent blight, where independent businesses are forced out because of “exorbitantly high rent…being raised astronomically." In case after case, landlords push out local businesses in order to hold out for luxury retail or corporate chains capable of paying higher rents. The result is a glut of empty storefronts, chain stores, pharmacies, and high-end national brands that often lack local character and don't provide goods and services the community needs.

State Senator Brad Hoylman said: “Bleecker Street serves as a cautionary tale of how high rents in the Village and Chelsea are pushing out longtime independent business. We can’t simply allow market forces to run roughshod over our community any longer. I hope the ideas in my report will ignite a conversation about how we can assist small businesses before -- not after -- they face the seemingly inevitable reckoning of enormous rent increases."

Steve Abrams, Owner of Magnolia Bakery on Bleecker Street, said: "Increased rents have affected many businesses on the street which certainly has had an impact on our overall business. We’re fortunate to have a landlord who understands the historic nature of our tenancy and has worked with us to keep our rent reasonable, allowing us to stay in the neighborhood. Though our profits are down slightly year-over-year, the rent compromise allows us to maintain profitability and keep our spot on Bleecker Street.

The report provides a number of solutions to address the growing problem of small business vacancies such as:

- Creation of a New York City Legacy Business Registry: The registry would track and maintain a list of small businesses that have been in operation for at least 30 years. This would enable New York State to recognize important businesses that in the future could potentially merit historic preservation tax credits and other benefits.

- Creation of Formula Retail Zoning Restrictions: This legislation would enable New York City to place limits on national chain stores.

- Phasing Out Tax Deductions for Landlords with Persistent Vacancies: Though landlords who leave retail storefronts vacant cannot deduct lost potential rental income, they are able to receive deductions for depreciation of property and operating vacancies. This proposal would disincentivize vacant storefronts by phasing out these deductions for building owners who leave retail spaces vacant over a year.

- Eliminating the Commercial Rent Tax: The Commercial Rent Tax (CRT) is an onerous and outdated burden on many small businesses. The tax only applies to commercial tenants in buildings below 96th Street in Manhattan, putting them at a distinct disadvantage compared to businesses elsewhere. State legislation could prevent the city from levying the Commercial Rent Tax on small businesses.

A copy of the report is attached and can be found online here.

Share this Article or Press Release

Newsroom

Go to Newsroom

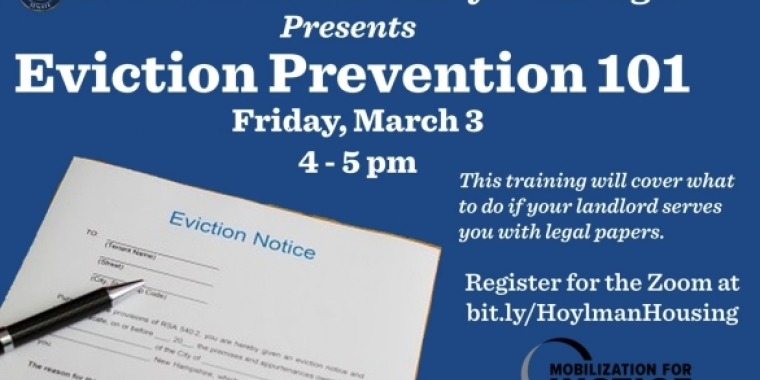

Eviction Prevention 101

March 3, 2023