Carlucci Secures Spring Valley Senior & Veterans Property Tax Exemption in State Budget

April 5, 2017

ALBANY, NY– Senator David Carlucci (D-Rockland/Westchester) announced that language to secure a property tax exemption for seniors and veterans in Spring Valley was included in the final agreement for a State budget. At the end of December 2016, the Village Board voted to disband the Village as a real property assessing unit. By law, the assessment of real property becomes the obligation of the Town of Ramapo and the Town of Clarkstown as the Village of Spring Valley is located in both of those towns. As a result, a significant number of property taxpayers would lose exemptions that were in Village law, authorized by the State but not opted into by either of the Towns. Carlucci was able to secure language in the budget to allow these property tax exemptions to be granted.

"The bottom line is that seniors and veterans need to get these property tax exemptions and we were able to deliver them. We could not allow individuals who were expecting to get a break on their property taxes to have that reversed on them because of a bureaucratic glitch," Carlucci stated.

It was determined that the Village of Spring Valley prior to December 2016 may have been granting partial real property tax exemptions for veterans and seniors that were permitted by New York State Law but not expressly incorporated into the Village code. Town Assessors can only recognize those exemptions which are enacted by the Village into law and not those which are permitted to be enacted by State Law.

If the Assembly does not pass this, seniors and veterans will not receive their exemptions.

###

Share this Article or Press Release

Newsroom

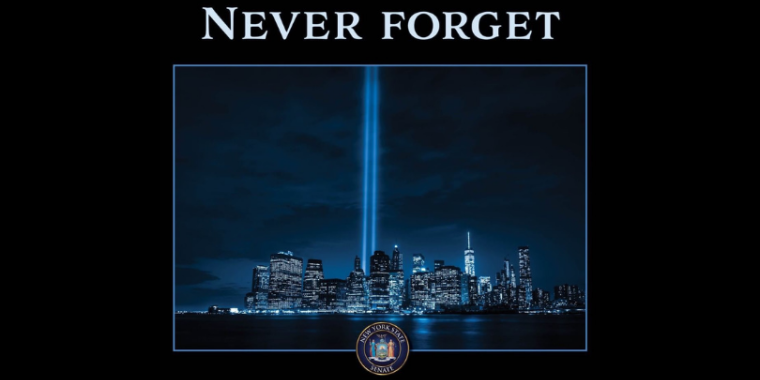

Go to NewsroomStatement From Senator David Carlucci on 9/11 Anniversary

September 11, 2019

Senator David Carlucci Calls for Investigation into Black Youth Suicide

September 10, 2019