Making New York More Affordable: Child Care

March 23, 2017

-

ISSUE:

- Child Care

Working parents know that balancing our job responsibilities and family commitments can be a challenge, and the rising costs of child and dependent care certainly don’t make it easier.

Here on Long Island, the cost of day care has increased four percent every year since 2009. That’s far outpaced the growth in most families’ paychecks, even as the cost of everything else seems to have kept going up too.

I’m working to find ways to make living here more affordable, both by cutting taxes and reducing everyday living expenses as well.

That’s why I’m especially excited about proposals in the new State Budget that would increase the value of tax credits that middle class families receive for expenses like day care, or for providing care for an elderly or disabled relative in your home.

This credit has not been increased in years, even as costs have risen. Now, the Senate, Assembly and the Governor has all outlined plans for a more generous Child and Dependent Care Tax Credit.

The Governor’s plan would double the existing Child and Dependent Care Tax Credit for families earning $50,000 or more a year. The Senate plan, modeled on a proposal I first outlined last year, would provide an even greater benefit, and includes special help for families with more than one child in a day care setting.

Beyond making day care more affordable, the Senate’s plan also goes further to help improve the quality and safety of day care services by creating a searchable, online registry that gives parents ready access to inspection records and other information that they can use when selecting the right day care for their children.

The Senate also would make it easier for state regulators to take action against rogue day care providers who violate safety and quality rules.

Finding affordable, quality and safe day care for our children doesn’t have to be hard. With the adoption of the new state budget, we have a chance to give Long Island families a chance to keep more of their hard-earned money, while also providing just a little more peace of mind.

Share this Article or Press Release

Newsroom

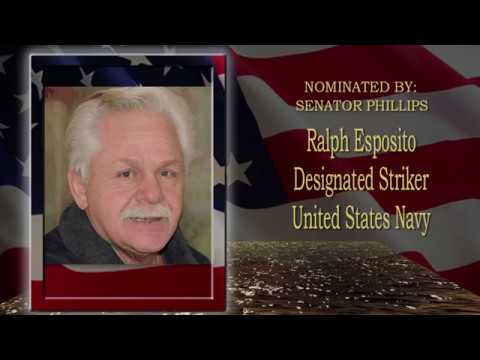

Go to NewsroomRalph Esposito

May 15, 2018