Senator Phillips: State Tax Dollars Should Not Be Used to Harm Israel

January 18, 2017

-

ISSUE:

- Israel

Senator Elaine Phillips (R-Manhasset) has introduced legislation to ensure that state tax dollars are not used to harm Israel and other American allies. The legislation would prohibit New York State from doing business with companies that seek to harm Israel and other American allies through movements like the anti-Israel Boycott, Divestment, and Sanctions (BDS), which is aimed at causing economic harm to Israel and the Israeli people.

“The BDS movement is an economic war against Israel. New York State should not be funding attacks against our allies. We must send a strong message that we stand with our friends and will not allow our tax dollars to be used by those wishing to harm them,” said Senator Phillips.

Current New York State law prohibits the state from directly engaging in an international boycott against American-allied nations. New York City has a similar prohibition as part of its administrative code. However, the existing state law leaves open the possibility that New York could indirectly support a boycott of American allies by providing state monies to businesses or individuals that participate in boycotts.

Senator Phillips’ legislation (S2492) would expand New York’s law by prohibiting state contracting with, or state investment in, businesses or individuals that promote or engage in activities to boycott, sanction, or divest in Israel and other American allied nations. This would prevent the state from becoming unwilling participants in a discriminatory agenda.

The Senate passed similar legislation last January, but the Assembly did not act. Governor Cuomo issued an Executive Order in June prohibiting state entities from contracting with, or investing in, entities that engage in or promote the BDS movement. While the Governor’s actions were a very positive step, an Executive Order is not law; a future Governor can repeal it at any time.

Senator Phillips’ legislation is necessary to codify these protections into law.

A number of other states adopted similar laws to prevent tax dollars from supporting BDS, including New Jersey, Alabama, Arizona, Colorado, Florida, Georgia, Illinois, Iowa, Michigan, Ohio, Pennsylvania, and South Carolina.

Share this Article or Press Release

Newsroom

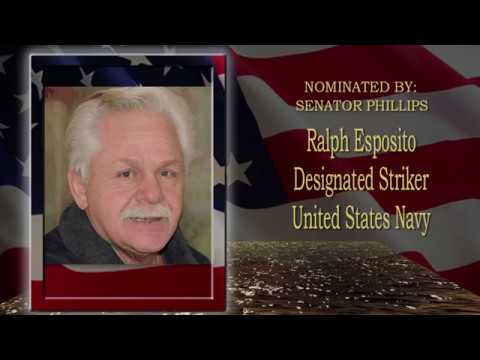

Go to NewsroomRalph Esposito

May 15, 2018