Senators Phillips, Hannon & Marcellino Introduce Legislation Restoring Nassau County’s Tax Abatement Program For Seniors

January 20, 2017

-

ISSUE:

- Property Tax

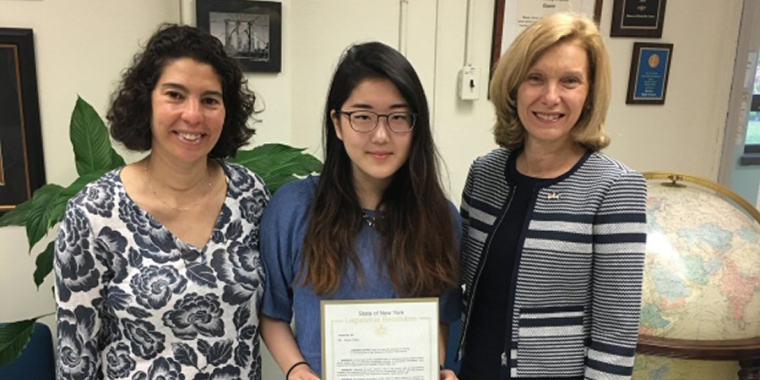

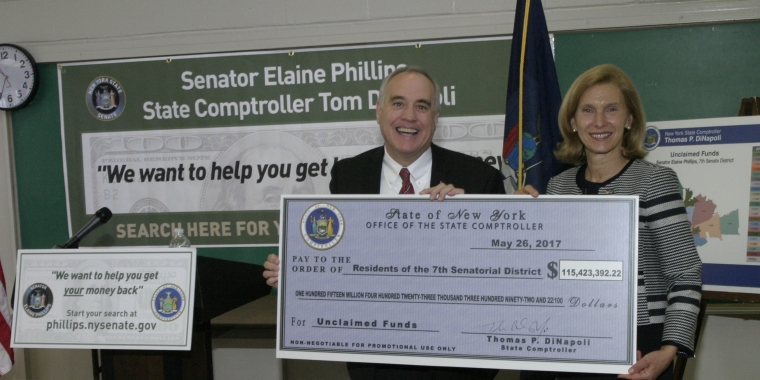

Senator Elaine Phillips (R-Manhasset), Senator Kemp Hannon (R-Garden City) and Senator Carl Marcellino (R-Syosset) announced that they have introduced legislation to restore Nassau County’s property tax abatement program for seniors. The program, which helps eligible seniors save money on their property taxes, expired at the end of 2016.

“Affordability is a major issue for Long Islanders, especially for seniors. Many are living on fixed incomes and already struggling to cope with the costs of taxes, healthcare, utilities and other necessary expenses. They cannot afford to have their taxes go up by hundreds of dollars. Restoring these important savings is vital. I look forward to working in a bipartisan manner with my colleagues in the State Legislature and Nassau County government to bring this program back for our seniors,” said Senator Phillips.

“When the County enacted their 19.3% County property tax hike in 2002, I worked with my colleagues to enact legislation creating the senior abatement, which permits seniors earning less than $86,000 a year to save 5.5% on their annual general property taxes,” said Senator Hannon. “With Nassau seniors still struggling to make ends meet, this is an absolutely necessary tax break. I’m pleased to work with Senators Phillips and Marcellino to restore, and make retroactive, this tax exemption.”

“Through all the back and forth on who is to blame for the expiration of the tax abatement for Nassau County seniors, the most important thing is that it gets fixed and it gets fixed now. This legislation will make sure that eligible Nassau seniors get the tax relief they need and deserve. Hopefully this is one of many bills that will pass this year to provide meaningful tax relief that will help seniors stay in their homes here on Long Island,” said Senator Marcellino.

In 2002, Nassau County increased county property taxes by more than 19 percent. To mitigate some of the impacts to seniors on fixed incomes, the County created a tax abatement program which provided tax savings. State approval was necessary to implement the program, which the County received. The abatement was scheduled to last until the end of 2016. The program’s expiration resulted in substantial property tax increases for seniors, many of whom were unaware that the program was ending.

The legislation introduced by Senators Phillips, Hannon and Marcellino (S3142) would authorize Nassau County to retroactively restore and continue the county program, ensuring that seniors do not lose out on valuable property tax savings.

The Nassau County Legislature’s Presiding Officer and members of the legislative majority have asked the state legislature to pass a reauthorization of the program.

Share this Article or Press Release

Newsroom

Go to Newsroom