CUTTING COLLEGE COSTS: THE IDC PLAN TO MAKE HIGHER EDUCATION ATTAINABLE BY ALL

March 9, 2017

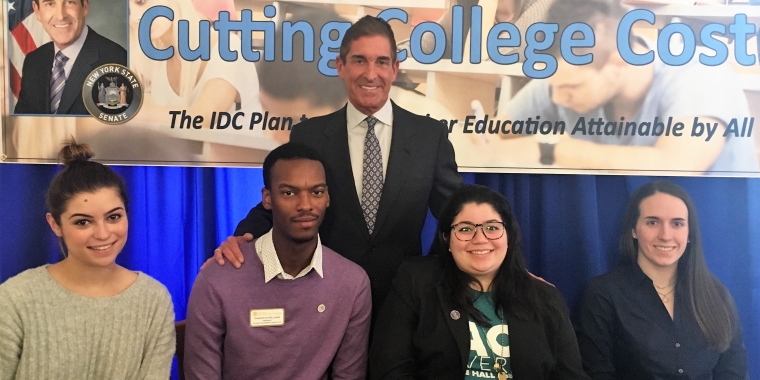

Senator Klein joins college officials to unveil new report,

legislative solutions on rising college costs

Bronx, NY — Senator Jeff Klein (D-Bronx/Westchester), joined by local college presidents, officials and students, released a report on the economic burden that post-secondary education has on New York families, “Cutting College Costs: The IDC Plan to Make Higher Education Attainable by All.” Klein also announced legislative solutions to ensure all young New Yorkers have the ability to pay for higher education.

The report drew on data from a multiple-choice questionnaire that the Independent Democratic Conference administered to college students in New York. The survey questioned students about their household income, plans to pay for college and their concerns about debt repayment following graduating. Legislative solutions were based off of the survey responses and data from institutions such as the College Board on the difficulty of paying for college.

“A college education is a crucial step to living a comfortable life with a well-paying job. But with the rising costs of a higher education, students and their families increasingly turn to student loans, ending up deeply indebted. College must be made more affordable for New Yorkers, and our students seeking a brighter future shouldn’t be penalized with outrageous loan payments. That’s why today I introduced the IDC’s seven-point proposal to cut college costs and give relief to our college graduates already in debt,” said Senator Klein.

Keys findings from the survey of New York State college students include:

- 67 percent of them and their families did not save any money for their college education.

- 57 percent of students were doubtful of their ability to pay off their student loans within the given loan period.

- 65 percent of the responders felt they wouldn't earn enough money upon graduating to afford their monthly loan payments.

- 64 percent of students have relatives or friends who have student loan debt.

Despite a lack of college savings, and a low confidence in their ability to repay student loan debt, many families must resort to student loans to cover the outrageous college costs. Because of this, Senator Klein and the Independent Democratic Conference have proposed a legislative package to cut college costs for New Yorkers.

The legislative proposals include:

- Reforming and expanding the TAP program - The IDC proposal includes expanding income eligibility for TAP from $80,000 to $125,000 and raising the minimum award from $500 to $2,000 over a three-year phase in period to provide more support to New York families. The proposal also includes providing TAP accessibility to all New York high school graduates regardless of their immigration status.

As part of these reforms, the IDC proposes restoring Graduate TAP for students in a combined undergraduate graduate program as well as increasing the time allowance of TAP aid from four to six years for disabled students who can demonstrate need.

- Establishing the College STAR Program - The IDC’s College STAR Program would increase the refundable tax credit for allowable tuition expenses for resident taxpayers. Under the program the credit would increase from the current 4% level to 25% up to the maximum allowable amount of $10,000.

- Establishing College Debt Freedom Accounts - This innovative proposal would allow employed residents to set aside part of their pre-tax income into an account to be used for undergraduate loan payments. Employers will be required to contribute a minimum of 50% of the total monthly student loan payment due with a $2,500 annual cap.

- Reinstating the Liberty Scholarship - Initially created in 1988 but never funded, the Liberty Scholarship would cover non-tuition expenses for full-time and part-time students, including room and board, transportation and books.

- Prohibiting consumer credit reports from including information regarding student loans - The negative impact that student loan information may have on a young person’s credit report can prevent them from making purchases such as a car or home. Prohibiting this information will allow protect them from having this negative information affect their lives.

- Establishing a Pre-Paid College Tuition Program - To save families thousands of dollars, the IDC proposes a pre-paid tuition plan that would lock in current tuition rates at participating New York public, private and independent institutions. Funds would be invested in a fund and returns would go to pay the participating institutions at the time the beneficiary attends college.

- Creating a task force to recommend ways lending institutions can offer - The IDC proposes establishing a task force bringing together the Office of the State Comptroller, the Higher Education Service Corporation, the Department of Financial Services, the chairs and ranking members of the Senate and Assembly committees on Higher Education and lending institutions in New York that offer private student loans to analyze ways that graduates can refinance their student loans and provide borrowers with more flexibility and reduce monthly payments.

The passing of these proposals would ensure that all New Yorkers are able to continue their education in an affordable way.

“Boricua College students are primarily Hispanic working adults, – 82% are women, heads-of-household. Since 2011-12, tuition at the College has increased by 2.5% as opposed to the State's increase of 9%. With the mean income of $16,000 annually, students fear getting into debt. The College works diligently to support students to graduation without amassing huge student loan debts. According to a study reported by the Commission on Independent Colleges and Universities (CICU), private and not-for-profit colleges are likely to lose 11% of students due to Governor Cuomo’s free tuition plan for SUNY and CUNY colleges. Students should have an alternative to public post-secondary education. We, therefore, earnestly welcome the efforts of IDC to help New York State’s low to middle-income students in their quest for affordable higher education,” said Dr. Victor G. Alicea, President of Boricua College.

“I commend State Senator Jeff Klein and the IDC on this effort to make college more attainable for those who are hungry to earn a better place in life. The plan also recognizes that students deserve to have a choice about where they attend college. Making higher education more affordable, regardless if the student chooses a public or private institution, is a wise and fair plan for all New Yorkers,” said Dr. Tim Hall, President of Mercy College.

“Senator Klein and the IDC are to be commended for these bold efforts to reduce the cost of student loans as a means to promote affordability. The plan recognizes that higher education is still the best investment that families and government can make in their futures. The plan also wisely recognizes that all students deserve support in making higher education more affordable, whether they choose to attend private or public colleges,” said Brennan O'Donnell, President of Manhattan College.

“We are very pleased that higher education and its economic benefits have become a central topic in state and national discourse. As such, any opportunity to work with our elected leaders towards keeping New York's private and public colleges and universities accessible for all students is especially welcome. We look forward to working with Senator Klein, the Legislature and the Governor in support of a higher educational agenda that will expand access and opportunity for the students and families we serve,” said Lesley A. Massiah-Arthur, Associate Vice President for Government Relations and Urban Affairs, Fordham University.

Share this Article or Press Release

Newsroom

Go to NewsroomIndependent Democratic Conference Minimum Wage Report 2013

February 12, 2013

Senator Klein Visits Students in Project BOOST Program at PS 72

February 11, 2013

Senator Klein Hosts Free Flu Vaccine Event in Riverdale

February 11, 2013