Senator Brooks Fights Against Unfair Penalties On LI Taxpayers

February 13, 2017

(Albany, NY)- Senator John E. Brooks (SD-8) co-sponsored a bill that passed the Senate today which would require the department of tax and finance mail out all advance payment STAR personal income credits by September 15th in order to allow taxpayers enough time to pay their school tax bills.

Homeowners have had their personal income tax credit (STAR PIT) reimbursement checks arrive late, while others received an inaccurate amount. This has caused a delay in the payment of homeowner’s school tax bills, by no fault of their own. This legislation also ensures that the state will reimburse the taxpayer for any penalties they ensue due to delayed payment of their tax bill from receiving their check late, as well require the state pay a 3% interest rate to the taxpayer for each day the credit is late past the school tax bill due date of September 30th.

“It is unfair to penalize taxpayers because their check from the state did not arrive in a timely manner," said Senator Brooks.

“It is time we stop punishing homeowners, who are already carrying a heavy tax burden, and do the right thing by ensuring they at least have a sufficient amount of time to pay their tax bills,” Senator Brooks continued.

Link to bill: https://www.nysenate.gov/legislation/bills/2017/S350

Share this Article or Press Release

Newsroom

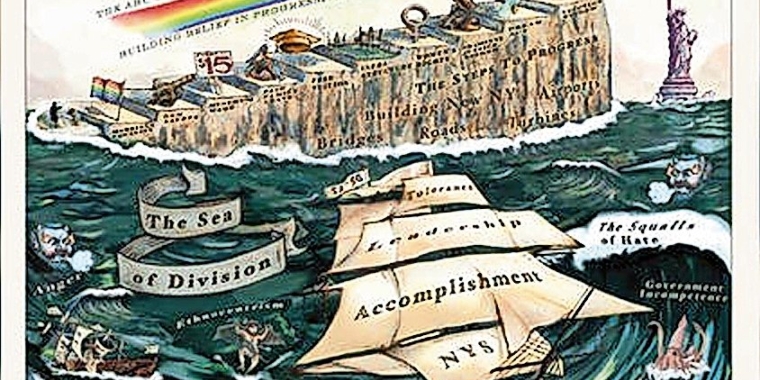

Go to NewsroomSouth Shore Does Well In State of State

January 17, 2020

Senator Brooks Prime Co-Sponsor of Bill Amending Bail Reform Law

January 16, 2020

Legion Hosts Veterans Day Service

November 14, 2019