Senator Phillips Calls On Governor To Reimburse Local Municipalities For Costs Incurred During Executive Order

January 10, 2018

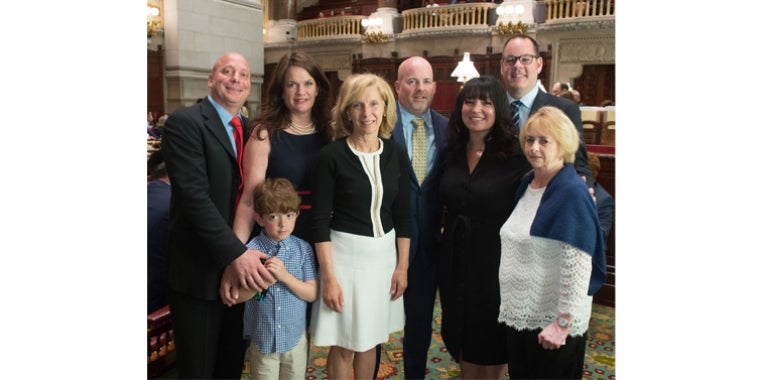

Senator Elaine Phillips joined Assemblyman Ed Ra and Town of Hempstead Receiver of Taxes Donald Clavin today to urge the Governor to reimburse local municipalities for excess costs accumulated while complying with an Executive Order allowing residents to prepay 2018 property taxes before January 1 deadline.

“While I commend the Governor on taking action to protect our hard-working taxpayers, local municipalities worked tirelessly to assist residents with prepaying their taxes before the new federal tax code took effect, and they should not be responsible for the excess costs accumulated due to the Executive Order,” Senator Elaine Phillips said. “I am confident we can find common ground to repay our local municipalities for the good deed they did for Long Island’s hardworking taxpayers. Taxpayers should not have to defray the cost, and this measure is the least we can do for local government.”

The Governor signed an Executive Order on December 22, directing local towns to accept the prepayment of 2018 property taxes. Town of Hempstead, Receiver of Taxes Clavin estimates that his office could incur excess costs of over $100,000. “Excess costs” are defined as costs beyond ordinary operating expenses during typical tax collections

Senator Phillips and Assemblyman Ra are currently drafting legislation that would provide reimbursements to those local governments which experienced excess costs as a result of the Executive Order.

“I want to thank Senator Phillips and Assemblyman Ra for stepping up to help local governments and area taxpayers as we all work to cope with the impact of the new federal tax code,” Clavin said. “By sponsoring legislation that would reimburse towns and other local governments for the excess costs of complying with the Governor’s Executive Order on the prepayment of 2018 property taxes, the impact of the costs to local governments and taxpayers can be minimized.”

“Hempstead Town and other municipalities have been slammed with excess costs in order to help taxpayers cope with the impact of the new federal tax code,” Ra said. “The least that our state can do is to help mitigate the burden that would otherwise be fully borne by localities and their taxpayers.”

Share this Article or Press Release

Newsroom

Go to Newsroom