State Senate Passes Unified Economic Development Budget Legislation

May 10, 2018

ALBANY - Today the State Senate unanimously passed S3354, sponsored by State Senator Liz Krueger, which would create a Unified Economic Development Budget for New York State, and allow all New Yorkers access to information regarding the billions of dollars in tax breaks, grants, and loans our state gives to corporations and other entities in the name of encouraging economic development.

“New Yok State is notorious for its complicated and opaque system of economic development incentives,” said Senator Krueger. “Coming up with a complete accounting of all the programs is extremely difficult. New Yorkers need to know how much money is being given away in the name of economic development, and, more importantly, whether that investment is actually creating meaningful jobs for New Yorkers, or is just wasteful corporate welfare.”

Other states such as Illinois, Rhode Island, and Vermont require a Unified Economic Development Budget as part of their budget process. The Citizens Budget Commission, which works to track the cost of these programs, estimates that in New York, the state and local governments spend $8.6 billion annually, including direct spending and tax expenditures, on various economic development programs. But the existence of so many overlapping programs makes it difficult to get a full accounting of these expenditures and whether they are achieving their stated goal of job creation. Furthermore, the myriad entities providing assistance makes it easy for savvy operators to get benefits from multiple sources, increasing the cost of these programs without providing additional benefits to the state.

S3354 requires the division of the budget to submit a unified economic development budget within three months of the end of the fiscal year that includes:

the total uncollected or diverted state tax revenues resulting from each type of development assistance for the most recent fiscal year for which reliable data are available, and the preceding five fiscal years;

the total amount of development assistance grants and loans awarded by all state and industrial development agencies to businesses, not-for-profit organizations and government entities for the most recent fiscal year for which reliable data are available, and the preceding five fiscal years;

a list of the top five recipients by dollar value of each type of development assistance grant or loan;

a list of all state development assistance with a description and aggregate amount of uncollected or diverted state tax revenues resulting from or awarded for each type of development assistance for the most recent fiscal year and its preceding fiscal year;

the aggregate amount of jobs created and/or retained with the support of development assistance.

The legislation also makes this information subject to the Freedom of Information Law and prohibits denying access because of confidentiality agreements between the state and recipients of state development assistance. In order to facilitate the collection and dissemination of this information, the legislation establishes a standardized application for state development assistance.

###

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom

Senator Krueger's January 2025 Update

February 3, 2025

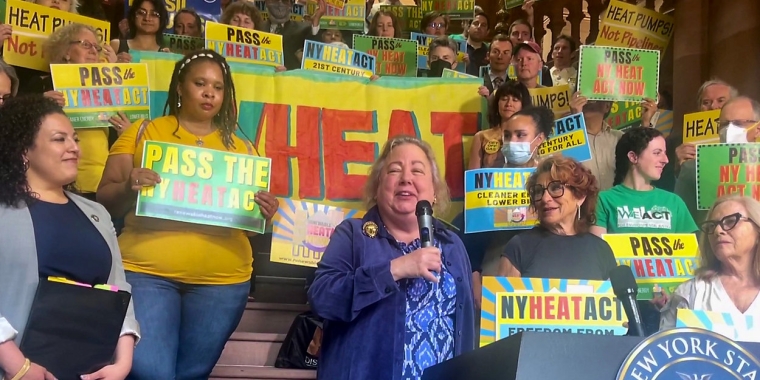

Senator Liz Krueger Announces Reintroduction of NY HEAT Act

February 3, 2025