Ranzenhofer Bill to Expand Child Tax Credit Passes State Senate

June 15, 2018

Albany, NY– The New York State Senate has passed legislation (S7815), sponsored by Senator Michael Ranzenhofer to expand New York’s Child and Dependent Tax Credit by doubling the current cap on child care expenses across the board.

“Child care is one of the largest costs facing parents. As more households rely on dual incomes to support their family, childcare is an increasingly necessary part of life in today’s economy. This legislation would be a step in the right direction and make childcare more affordable in New York State. I urge the Assembly to bring this important legislation to a vote this session,” said Ranzenhofer.

The proposed expanded tax credit is estimated to provide $225 million in new relief for middle-class families. Most families are estimated to receive a new average credit of $750, an increase of $375 from last year.

Under existing law, taxpayers are eligible to claim the Child and Dependent Care Tax Credit to help offset the costs of caring for a child under the age of 13, a disabled spouse or a disabled dependent. The expense amount allowed toward the credit is limited at various levels depending on the number of children.

Identical legislation in the Assembly, A10265, is currently in the Assembly Ways and Means Committee. If enacted, taxpayers would be able to take advantage of the increased limits starting in 2019.

###

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomSweet Home Educator Named Teacher of Excellence

September 26, 2016

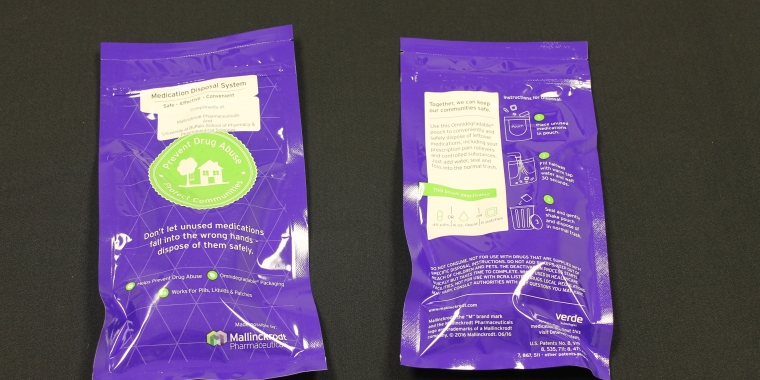

Drug Disposal Pouches Available at Ranzenhofer District Office

September 26, 2016

Newstead Fire Company Memorial Garden

September 24, 2016

Care Packages for U.S. Troops Overseas

September 24, 2016