Senator Helming Announces Signing of Bill to Support Hops Farmers

Senator Pam Helming

August 27, 2018

-

ISSUE:

- Agriculture

GENEVA – Senator Pam Helming today announced that her legislation to give hops farmers the opportunity to apply for agricultural tax exemptions has been signed into law. The legislation (S.8841) will help ease the burden on hops growers and support the continued growth of New York’s hops industry so that it can meet the demands of the many new breweries opening across our region. With more than 400 brewers in New York State and more than 70 here in the Wayne-Finger Lakes region, this measure levels the field with orchards and vineyards, which can already apply for such tax exemptions.

“As Senate Chair of the Legislative Commission on Rural Resources, I heard from various stakeholders who agreed that it is vital to support our hops farmers who supply the New York-grown ingredients to our brewers. We brought people together across party lines to get this important legislation passed. My legislation, coupled with the additional $100,000 in funding for Cornell’s hops and barley research in this year’s budget, are critical steps forward that will encourage our farmers to continue to grow hops and provide the state’s booming craft beverage industry with the local resources they need to continue to thrive. Working with the Legislature, we have helped New York’s farming, food, and beverage industries grow exponentially and draw visitors to try some our award-winning products. I thank my Senate and Assembly colleagues for their bipartisan support of this bill, and I thank the Governor for signing it into law,” Senator Helming said.

The law provides hops farmers with relief from the annual gross sales requirement and encourages them to plant new hopyards in New York State. Under current law, certain orchards and vineyards qualify for a real property tax exemption without meeting a $10,000 sales requirement since these crops take longer than most to reach their full potential. Similar to crops produced on orchards and vineyards, hops also do not reach full production until years after planting. Farmers can receive tax benefits in their first, second, third or fourth year of production when using at least seven acres or more of land to produce hops. Farmers can also receive a partial tax exemption for the first six years of replanting or expanding their production of hops.

related legislation

Share this Article or Press Release

Newsroom

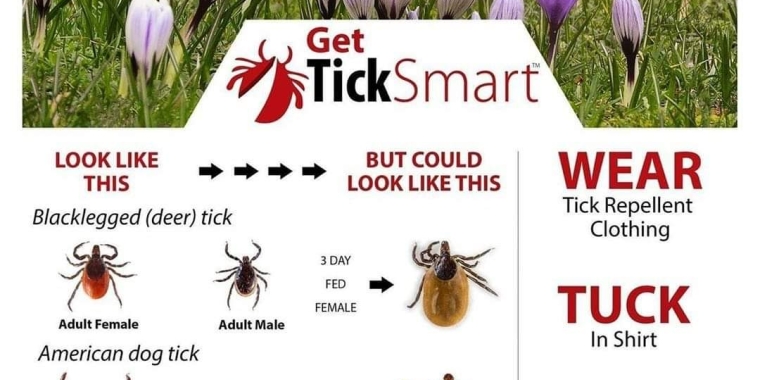

Go to NewsroomHelming: Fight the Bite

April 23, 2020

Senator Helming's Statment Regarding Nursing homes

April 21, 2020