Clarification on Bereavement

August 8, 2018

For Immediate Release: August 8, 2018

Over the last week, a hysteria has developed in relation to a simple bill to provide paid time off to an employee who loses a loved one.. A good example is former Lieutenant Governor Betsy McCaughey calling this bill “the last nail in the coffin” for business in this state. As someone who buried his own son, I take strong exception to that imagery, and I am sure that other grieving families will as well. What we need here are facts, and not hateful rhetoric and outright lies.

This bill does not cost businesses any money—not one red cent. The cost of the insurance that covers Paid Family Leave in the state is covered by the EMPLOYEE not the EMPLOYER. That employee-funded payment is regulated by the Department of Financial services and currently set at $86.25 a year.

Employers DO NOT have to pay the salary of a temporary employee and an employee on leave at the same time. The worker taking leave is covered by the insurance that he or she pays for in each paycheck. The business owner only pays the salary of the temporary worker who fills in.

In every story, there is this continuous claim that employees will all defraud the system and take the maximum allowable leave of 12 weeks. Well, let’s take a closer look at that specious claim. First, the maximum amount of leave a worker can take is currently 8 weeks per year and it phases up to 12 weeks. If a mother took 8 weeks to bond with her newborn baby and God forbid lost that child later that year, under this bill she would receive NO ADDITIONAL LEAVE.

Let’s play this out further. Someone on paid bereavement leave would receive between 50-67 percent of their pay from the insurance carrier—not the employer. How many working families can afford to be away from their job collecting half of their salary for 12 weeks? The answer is not many, and certainly none that don’t truly need the time.

This bill is a common sense public policy change that protects a worker from losing their job when they need additional time to grieve the loss of a loved one. Since the Business Council’s own study shows that a typical employer provides only four days for this purpose, this change seems badly needed for an employee who may need to regain their focus.

It’s amusing to sit here and watch business groups and talking heads seek to crush an effort to provide a minor benefit to someone who has lost a child, while much bigger threats loom on the horizon. As we speak, some are pushing for government-run healthcare at a cost to taxpayers of $70 billion, a horrific “call-in” scheduling regiment that actually will cost a business money, and gutting the tipped wage credit to the detriment of employers and workers alike. These are the mortal threats to our economy in New York State and that’s what I am focused on.

No bill is perfect, and I am always open to discussing ways to improve legislation I sponsor—this included. What I will not do is sit back and say nothing while opponents outright lie.

Share this Article or Press Release

Newsroom

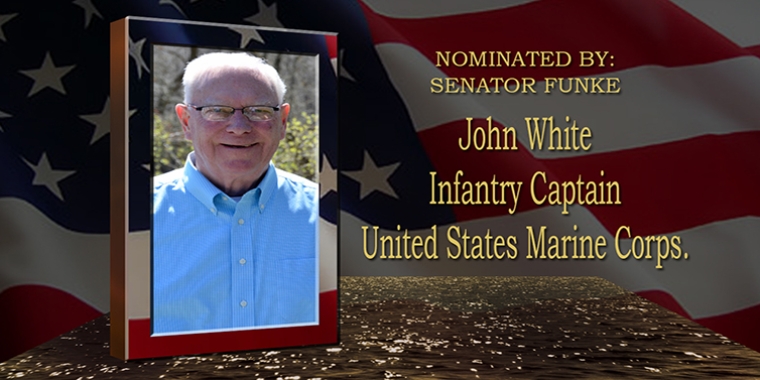

Go to NewsroomJohn White

May 20, 2016

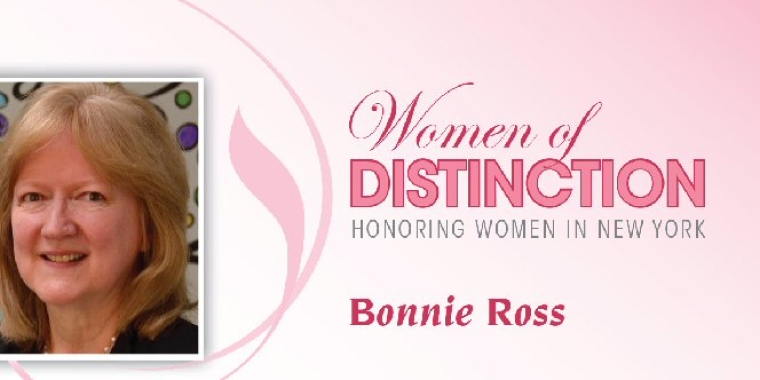

Bonnie Ross

May 12, 2016

Earth Day 2016 Poster Contest: District 55

April 14, 2016