Felder Legislation Protects New Yorkers from Millions in New Tax Increases

January 23, 2018

-

ISSUE:

- Tax Reform

- 2018 Affordability Agenda that focuses on broad-based tax relief for families and seniors

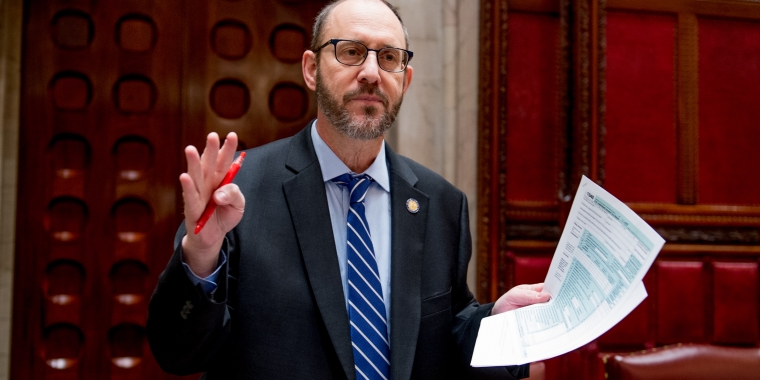

January 23, 2018 - Senator Simcha Felder’s (D-Midwood) legislation (S.6974A) was passed unanimously by the Senate today. The bill saves hardworking, New York taxpayers from millions in additional state taxes.

Under Senator Felder’s leadership and in a show of unity, Republican, Democrat and IDC Senators joined to protect New Yorkers from the toxic trend of overtaxing.

“We can point a finger at Washington and scream and yell, but by doing nothing to address the issue we would be equally to blame by hurting hardworking New Yorkers,” said Senator Felder.

Felder’s legislation protects over 5 million tax filers in New York who would be on the hook for an additional $800 million in taxes and saves another $400 million for New Yorkers who itemize. All considered the total savings of this legislation is estimated at a staggering $1.5 billion to taxpayers.

New York State Tax law builds off the federal tax law in many ways. State income tax is calculated by using the Federal taxable income (AGI) which many New Yorkers will see rise steeply because of the elimination and capping of deductions.

“This legislation will ensure that hardworking New Yorkers don’t get caught in the cross hairs of political maneuvering. By holding the line on State income tax for New York taxpayers, we alleviate this state of double jeopardy. We can’t change Federal tax law, but we can protect New Yorkers from harm when they file their state taxes irrespective of those changes in Washington,” said Felder.

“This bill is about protecting every taxpayer in New York and making sure everyone can reap the benefits of tax-relief. We are working hard every single day to make sure New York is a more affordable place to live, said Senator Catharine Young (R-I-C, Orleans). Our Senate Conference understands that hardworking, overburdened New Yorkers need tax relief, and that’s why we have led the charge to cut taxes by $12 billion over the past few years. Our efforts have included everything from providing savings on people’s utility bills, to slashing the personal income tax for middle-income New Yorkers to the lowest level in 70 years, to protecting the STAR property tax relief program. I thank Senator Felder for his leadership and all my colleagues who knew this was an important issue.”

“If this bill did not pass, the State of New York would be collecting an additional $1.5 billion from taxpayers,” Said Senator John DeFrancisco (R-I-C, Syracuse). By passing this bill we protect New Yorkers from the State throwing a $1.5 billion missile at them.”

“We are responsible to do everything in our power to save hardworking, over-taxed New Yorkers from any additional tax burdens. New Yorkers shouldn’t be the collateral damage of Federal tax reform. This bill rights an egregious injustice that would have cost New York taxpayers billions!” concluded Senator Felder.

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomFelder Outraged by Unacceptable “Relocation” of Midwood Post-Office

December 15, 2023

Felder Challenges Sunday Shutdowns at Brooklyn Libraries

December 11, 2023