New York State Senate Passes Trust Act, Enabling Congress to Request Trump's State Tax Returns

May 8, 2019

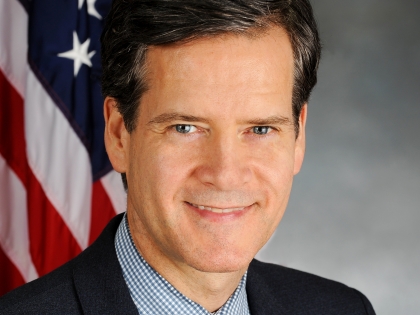

ALBANY, NY - Senator Brad Hoylman (D/WF-Manhattan) released the following statement in response to the passage of his TRUST Act (S.5072-A/A.7194-A), which would authorize the New York State Department of Taxation and Finance to share tax return information with a requesting Congressional committee:

Senator Hoylman said: “Donald Trump has broken forty years of political tradition by not releasing his tax returns. Now, his administration is precipitating a constitutional showdown by shielding the President from Congressional oversight over those returns. Our system of checks and balances is failing. New York has a special role and responsibility to step into the breach.

Today, the New York State Senate voted to do its part to assist Congress in fulfilling its oversight responsibilities by passing the TRUST Act, allowing the New York State Department of Taxation and Finance to cooperate with Congressional committees requesting New York State tax returns. I am grateful to Senate Majority Leader Andrea Stewart-Cousins, my colleagues in the Senate, and my partner in the Assembly, David Buchwald. I look forward to seeing the bill pass both houses, and reach the Governor’s desk for a signature. We must ensure that Congress can’t be blocked in their attempts to hold even the highest elected officials in the land accountable to the American people.”

House Judiciary Chairman Jerrold Nadler said: “This bill is a workaround to a White House that continues to obstruct and stonewall the legitimate oversight work of Congress. The state return should generally match the federal return and obtaining it from New York State will enable us in Congress to perform our oversight function and maintain the rule of law.”

Assemblyman David Buchwald (D-Westchester), lead sponsor of the TRUST Act in the New York State Assembly said: "We see bold action in the State Senate, moving to provide New York state tax returns requested by Congressional committees. Senator Hoylman and his colleagues in the State Senate deserve great credit for recognizing that it is time for New York State to step up and promote transparency of tax returns, especially when the U.S. Treasury Department is denying the rights of Congress. The State Assembly should responsibly and promptly move forward and take up the measure because no one is above the law.”

House Ways & Means Chair Richard Neal formally requested President Trump’s federal tax returns earlier this month, setting an initial deadline of April 10. The White House also failed to comply with the second request, set for April 23. Earlier this week, Treasury Secretary Steven Mnuchin formally denied the committee’s request.

Federal law gives three Congressional tax committees the unqualified right to obtain and review the otherwise confidential federal tax information of any taxpayer from the U.S. Department of Treasury. Under New York State tax law, sharing state tax return information is prohibited, except under certain delineated circumstances. The TRUST Act would create a new exception to authorize the sharing of state tax returns with a requesting Congressional committee when the request is made in the furtherance of a legitimate legislative purpose.

###

Share this Article or Press Release

Newsroom

Go to NewsroomLetter to the Attorney Grievance Committee on Rudolph Giuliani

January 11, 2021