Senator Brad Hoylman Responds To California's Passage of Presidential Tax Transparency Legislation

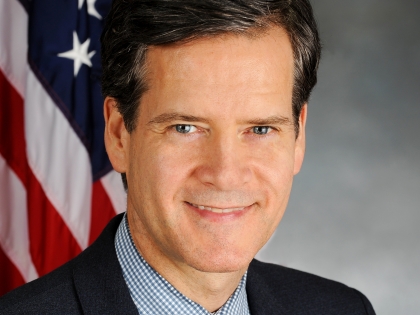

Senator Brad Hoylman

July 30, 2019

-

ISSUE:

- Tax Transparency

NEW YORK, NY – Senator Brad Hoylman (D/WF-Manhattan) released the following statement in response to California Governor Gavin Newsom signing SB27 into law, which requires all presidential candidates to submit five years of income tax filings in order to secure a spot on California’s presidential primary ballot. The law is modeled after Senator Hoylman’s bill S.32-A, first introduced in December 2016. Similar legislation has since been introduced in over 30 states.

Senator Hoylman said: “If we’ve learned anything from President Trump’s election, it’s that the political norms we take for granted in America can be shattered in an instant if they aren’t enshrined in law. Trump broke forty years of political tradition by refusing to release his tax returns, denying voters essential information on potential conflicts of interest as well as his financial well-being and how much he gave to charity. Today, I applaud Governor Newsom, California State Senators Mike McGuire and Scott Wiener, and the members of the California State Legislature for defending American voters’ interest in tax transparency and for demanding that all presidential candidates disclose their tax filings.

With the Trump Administration and a divided Congress unlikely to act on these issues, it is up to the states to protect our nation’s most important democratic norms. New York’s recent passage of the TRUST Act has provided a crucial avenue for Congress to exercise its lawful oversight responsibilities. Now, California and its 55 electoral votes will make a significant national impact with this law.

I encourage my colleagues in the New York State Legislature to act promptly and vote to pass S.32-A as soon as we return to Albany.”

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom2016 Winter Newsletter

January 4, 2017

Change.org: Support the TRUMP Act: No Presidency without Tax Returns

December 16, 2016