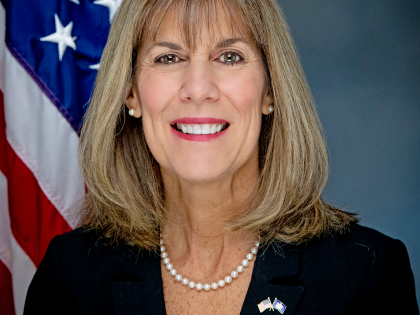

Statement from Senator Daphne Jordan (R,C,I,Ref-Halfmoon) on voting to make the property tax cap permanent

January 23, 2019

“From the very first day of my Senate campaign, I called for making the property tax cap permanent to protect taxpayers. Today I kept that promise. Since its enactment into law, the property tax cap has saved New York taxpayers $37 billion. We need to continue these savings for overtaxed homeowners.

While a permanent property tax cap is great for taxpayers, the lack of unfunded mandate relief to protect local governments, and ultimately local taxpayers, is a serious concern. Instead of providing unfunded mandate relief, the Democratic Majority is adding even more unfunded mandates, most notably in the form of their early voting initiative, which will drive up costs for local governments. In addition to the Senate Democrat’s early voting unfunded mandate – which was rammed through with no public hearings – are the Governor’s proposed cuts to the AIM program that will hurt our towns and villages. Having served in local government, I know this is a devastating one-two punch for localities. Local governments have already cut costs and do more with less. It’s time Albany did the same and live under a statutory two percent spending cap.

While our enactment of a permanent property tax cap today is good news, it can’t be the end of a long overdue conversation about Albany’s unfunded mandates. Albany must stop passing the buck and start eliminating unfunded mandates so we can better protect taxpayers and our local communities.”

###

related legislation

Share this Article or Press Release

Newsroom

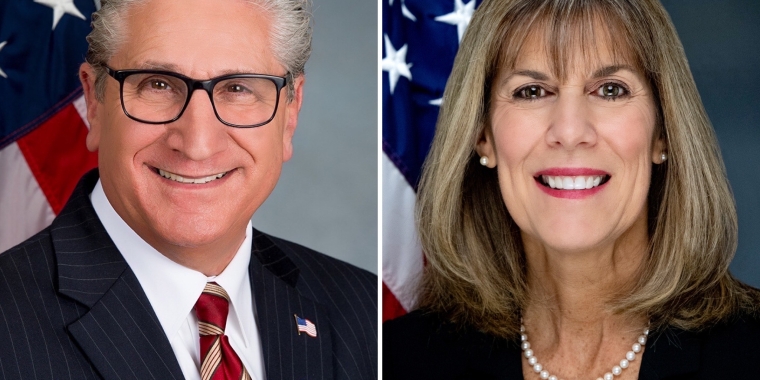

Go to NewsroomTedisco & Jordan: “Cuomo Lied and New Yorkers Paid and Died”

February 15, 2021

Hiding 15,000 Deaths is Not a "Political Position"

February 12, 2021

Protecting Local Taxpayers and Services

February 11, 2021