Senator James Sanders Jr. Hosts a "Fintech Roundtable" Emerging Issues in Fintech: Blockchain, Online Commercial Lending, and the Underserved

May 21, 2019

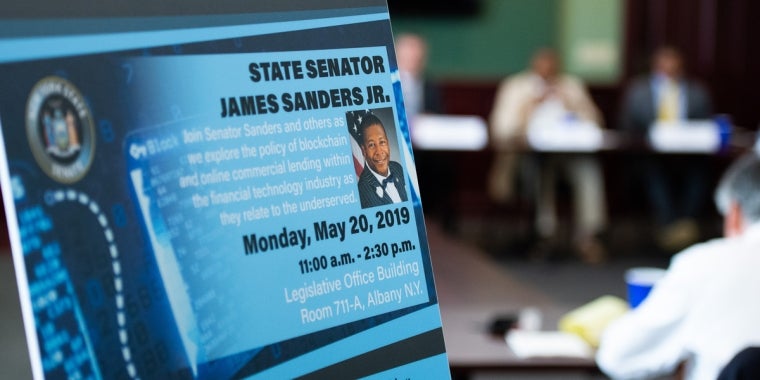

Senator James Sanders Jr. (D-Rochdale Village, Far Rockaway) hosted a Fintech roundtable "Emerging Issues in Fintech: Blockchain, Online Commercial Lending, and the Underserved” on May 20, 2019, in the Senate & Assembly Conference room in the Legislative Office Building in Albany, New York. It focused on the policy of blockchain and online commercial lending within the financial technology industry as they relate to the underserved.

The purpose of the event was to serve as an opportunity for legal experts, industry representatives, and blockchain leaders to discuss the legal and regulatory environment in New York State as it pertains to the fintech industry. Panelists drew on their experiences in the industry and working with the government to provide their perspectives on how the state legislature should engage with the fintech industry to meet the needs of the underserved, foster innovation, and establish the state as a leader in the industry.

Senator Sanders lead the discussion with Fellow Senate and Assembly colleagues: Senator Anna Kaplan, Chair of Committee on Commerce, Economic Development, and Small Business; Senator Diane Savino, Chair of Committee on Internet and Technology; Senator Kevin Thomas, Chairman of the Committee on Consumer Protection; and Assembly Member Clyde Vanel, Chair of Subcommittee on Internet and New Technology joined Senator Sanders in leading this discussion.

Assembly Member Vanel, who moderated the first panel on Blockchain and the Underserved, described blockchain technology as a decentralized, distributed and public digital ledger, which is used to record transactions among numerous computers. These records cannot be changed without changing all the records. Blockchain technology gives control over both privacy, accuracy and transparency. These attributes promote trust in the system. Blockchain technology can be used in banking, business, and most any field that involves transactions and records.”

Senator James Sanders Jr. and PJ Hoffman, the Director of Regulatory Affairs moderated the second panel, Online Commercial Lending and the Underserved, for the Electronic Transactions Association. The Electronic Transactions Association has over 500 member organizations. Senator Sanders asked the panelists how the digital age could benefit the underserved. Panelists pointed out that online commercial lending has opened up new opportunities to small businesses that could not receive loans through conventional means. However, there was concern raised about bad actors giving loans to those who were too high risk to be able to pay the loan back, particularly after being charged with high interest rates. Since there is very little federal regulation in this area, each state has different regulations which makes this complicated legally for companies to operate in multiple states.

Senator Sanders closed out the event by stating that, “blockchain and online lending are relatively new fields and future regulation by the state should be considered.” As we move toward fintech, the Senator is exploring policies to both promote economic growth while protecting small businesses and consumers from fraud and predatory practices.

Share this Article or Press Release

Newsroom

Go to Newsroom