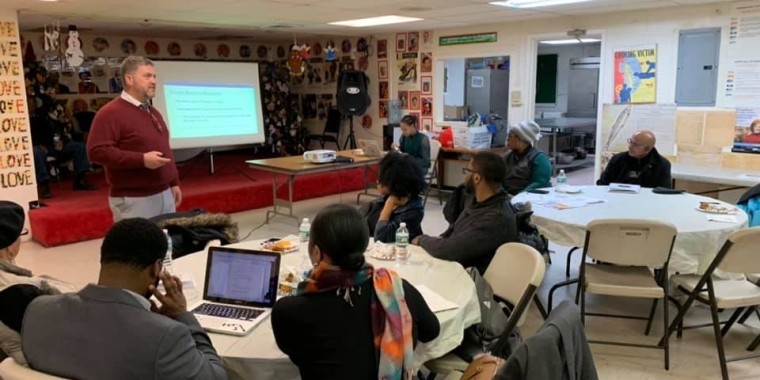

Senator Sanders Hosts Successful Community & Clergy Event on Financing Higher Education and Reducing Student Debt

December 30, 2019

Senator James Sanders Jr. (D-Rochdale Village, Far Rockaway) partnered with the Department of Financial Services and Community Service Society to provide an in-depth presentation on how to manage student loan debt through greater financial literacy and providing access to new resources. The goal was to help faith-based and other community leaders better understand the nuances of student loan debt repayment.

Dozens of people attended the event which was held on December 19, 2019 at Rush Temple AME Zion Church in Jamaica.

"It is said that when you find yourself in a hole, the first thing you should do is stop digging," Sanders told the crowd. "So let's accept that the community as a a whole, is in a hole, and the first thing we need to do is stop adding to the debt."

Attendees received information about the Public Service Loan Forgiveness Program as an alternative to repayment as well as all repayment options for Federal Student Loans including income-based payment arrangements and graduated and extended repayment plans. They gained knowledge on other topics such as forbearances, deferments, loan consolidation and rehabilitation. Also, methods to bring loans out of default and stop wage garnishment were reviewed along with options for borrowers with private student loans.

Scott Ahrens, Student Protection Program Administrator, with New York State Department of Financial Services discussed the steps to selecting the right repayment plan, noting that there are many options including flexible plans based on income. He explained that if a person does not choose a repayment plan for their federal student loans, they will automatically be enrolled in the Standard Repayment Plan, however, you can change your federal repayment plan at any time. Repayment plans for private loans vary depending on the lender; and you should contact your lender to discuss your options, Ahrens advised.

The Standard Repayment Plan is a monthly fixed payment that will be set at an amount that will allow the borrower to pay the loan off in 10 years (or 30 years for consolidated loans). The payment will be at least $50 a month and you will pay less interest than you would under the Graduated or Extended Plans.

One prominent question among is attendees was what happens if a person can't, or doesn't, make payments on their student loan. An account is considered delinquent when a payment is owed one day past the due date. Loan servicers may report delinquencies of at least 90 days to the three major credit bureaus. They will also attempt to contact you to resolve the delinquency.

If you have defaulted on the loan, meaning a payment is more than 270 days past due, the consequences become more serious and may include: having your loan assigned to a collection agency, having federal and state tax returns withheld, having your wages garnished, and facing legal action.

Nancy Nierman and Carolina Rodriguez presenters with the Education Debt Consumer Assistance Program (EDCAP) explained that help with loan repayment is available through the Public Service Loan Forgiveness Program (PSLF) and the Temporary Expanded Public Service Loan Forgiveness Program (TEPSLF).

The PSLF forgives the remaining balance on your direct loans under the following circumstances: if you have made 120 qualifying payments (10 years), are under a qualifying repayment plan, while working full time for a qualifying employer. Forgiven loan amounts are not subject to income taxes under this program.

The TEPSLF is a temporary program under the Department of Education that provides "limited, additional conditions under which you may become eligible for loan forgiveness," and is provided on a first come-first served basis. Once funding runs out, the TEPSLF opportunity will end.

For more information visit https://www.dfs.ny.gov/ or https://www.cssny.org/

We would like to thank Rush Temple AME Zion Church for allowing us to use their space to host the event.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator James Sanders Jr. Hosts Fire Safety Session with FDNY

February 28, 2022

![Ukraine leader says at least 137 killed in Russian attack as Western powers announce series of sanctions against Moscow. Photo: [Nick Lachance/Reuters]](/sites/default/files/styles/760x377/public/press-release/main-image/sanders_sd10_ukraine.png?itok=JnrVEBNp)