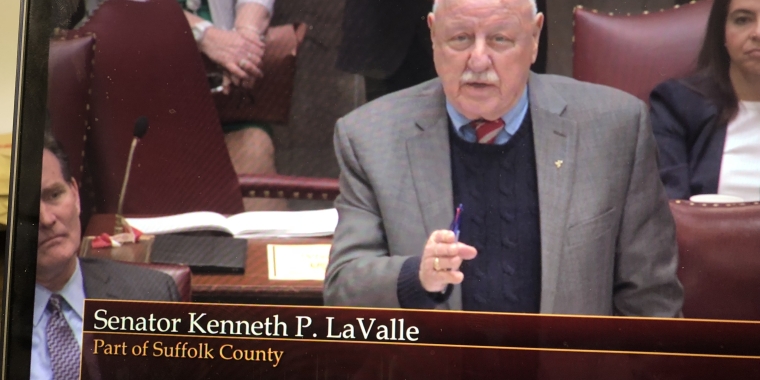

Senator Ken LaValle: Why I voted against the Senate Budget Resolution this year

March 13, 2019

Albany, March 13, 2019 – Senator Ken LaValle announced the many reasons that he voted against the Senate’s one house Budget Resolution today.

Senator LaValle said, “The budget that was proposed today by the New York City dominated Majority includes a $2 billion dollars increase in taxes for this year alone. That is an outrageous amount of taxation. Throughout my career, I have pledged to work to make Long Island more affordable for our families. I was the author of the STAR tax relief program, helped pass the 2% property tax cap and continue to fight to make it permanent, approved the property tax rebate check program, successfully worked to keep State education aid at proper levels for our schools and approved a historic 3-year state income tax cut. We need to have the state lead the way in working to keep people here on Long Island, and not force them to leave because they cannot afford to stay. I will continue to strive to make Long Island affordable and will strenuously oppose increasing taxes and fees on our residents.”

The Majority Senate’s one-house budget resolution ignores the great need for meaningful tax relief and, instead, raises taxes by $2 Billion just this year alone. Inexplicably, it not only pierces the two percent spending cap we have adhered to for the last 8 years, but it completely obliterates it spending far more than our taxpayers can afford.

The Republican Senate Conference believes that spending must be reined in at a 2% cap. Generating real opportunity is the key to creating a better business environment for New Yorkers, and additional revenue for this state.

Unfortunately, the blatant disregard of the need to keep taxes low, once again highlights the debacle that led to Amazon with their 25,000 good-paying jobs and $27 billion in revenue to flee New York State.

Specifically, the NY City dominated Senate Budget Proposition would increase taxes by:

- Ending property tax rebates;

- Adding a new tax on Internet purchases;

- Creating a new Driving Tax, or in the case of the Assembly, a new Gasoline Tax;

- Taxing medication and prescription drugs;

- Taxing the use of paper grocery bags

- Taxing real estate purchases;

- Creating a Welfare Fund for Politicians to use your tax dollars to run their own campaigns;

- Taxing the high income earners who are the most likely to leave our high tax state even more.

In addition to adding an enormous amount of taxes, the proposal also uses slight of hand:

- Slashes community college funding, while giving our tax dollars to illegal immigrants so they can attend college for free.

- Restores Medicaid funding, while cutting money from nursing homes where our most vulnerable residents depend on round-the-clock care.

- Leaves counties burdened with unfunded mandates by advancing just $10 million for early voting, even though they approved legislation on the first week of session knowing it would cost $500,000 to $1 million per county. That doesn’t even account for electronic poll books, another piece of legislation passed, which will take tens of millions of dollars more to implement.

- Hastily advances a proposal for marijuana legalization, without the proper in-depth planning, education and complete transparency necessary for such a tremendous undertaking

Senator LaValle concluded, “The New York must adopt a permanent 2% tax cap for the state budget, so these types of outrageous tax increase proposals are never imposed on our residents. The 2% property tax cap we imposed has already saved taxpayers $37 Billion dollars, and the state need to follow suit and immediately impose a 2% cap on itself to stop this excessive $2 Billion dollar extortion of our residents.”

###

Share this Article or Press Release

Newsroom

Go to NewsroomGail Lynch Bailey

May 13, 2015