“Bill Of Rights” For Star Recipients

February 21, 2019

(Mount Kisco, N.Y.) New York State Sen. Pete Harckham (SD40) today announced that he would sponsor a “Bill of Rights” for STAR recipients to help fix a system that is often unresponsive to taxpayers and sometimes keeps them waiting for years for rebates.

“It is unacceptable that taxpayers have to wait so long for money they are owed,” Harckham said. “If the IRS can issue most tax refunds within 21 days of filing, why can’t the state have a quick turnaround time for rebates?”

Harckham said his office has received STAR complaints from several constituents, some of whom have waited for rebate checks from as far back as 2016. Constituents also complained about running into an unresponsive bureaucracy when they called the state tax department to inquire about their rebate.

Cross River resident Michael Falsetti, whose rebate issues date back to 2016, said “the problem is that you cannot get through to the department that’s handling the refund. There is zero accountability. They kept telling me ‘call back in a few weeks.’”

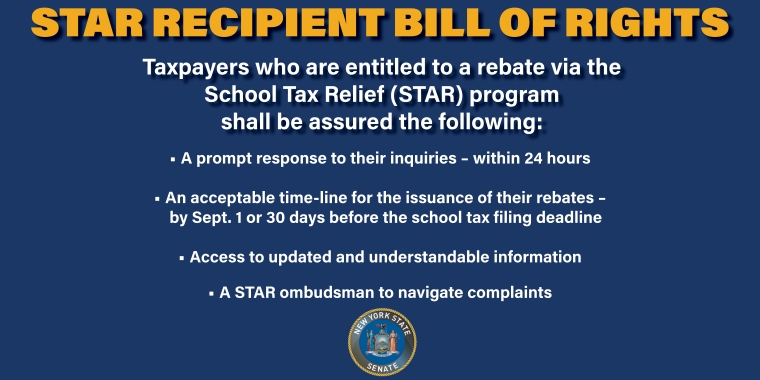

Harckham will introduce legislation that would support a STAR “Bill of Rights,” which would help set standards for communications with taxpayers and help improve the turnaround time of rebates.

The state’s School Tax Relief (STAR) program was introduced in 1997. STAR credits can average about $750 for basic STAR and about $1,400 for Enhanced STAR for seniors.

The state shifted the STAR program from being an upfront savings on property owners' school tax bills to a check sent by the state tax department for people who bought homes after Aug. 1, 2015, or didn't first apply for STAR since May 1, 2014.

Share this Article or Press Release

Newsroom

Go to Newsroom

Harckham Applauds Nearly $400,000 in Grants to SD40 Counties for 911 Centers

September 17, 2019

Senator Pete Harckham's Community Bulletin - September 2019

September 17, 2019