Senator Persaud's Bill (S1089) That Exempts Funds From Qualified Tuition Plans When Qualifying for Public Assistance Passes Senate

May 1, 2019

On May 1, the Senate passed Bill S1089, which would amend the social services law in relation to disregarding funds in a federal qualified tuition program — known as 529 Accounts or "qualified tuition plans" — during public assistance assessments. These tax-advantaged savings plans are intended to help families save for future higher education expenses but are currently considered during assets limit tests conducted when determining whether households qualify for public assistance. Sponsored by Senator Persaud, the legislation seeks to codify regulations harmonious to already-existing New York State regulations so families in the federal program are not penalized for saving money to afford future education plans.

"I thank the Senate for approving my legislation that will help public assistance households with qualified tuition accounts (“529 Accounts”) to retain their savings needed to pay for higher education," Senator Persaud said. "Education is a pathway out of poverty toward self –sufficiency; households that participate in this federal program should not be forced to spend-down education savings in order to receive assistance. S1089 codifies exemptions already provided for in state regulations and agency guidance."

Share this Article or Press Release

Newsroom

Go to Newsroom30 years: New York State Office for the Prevention of Domestic Violence

February 16, 2023

Senator Persaud's Weekly E-Newsletters

January 8, 2023

CALL FOR CAPITAL FUNDING REQUEST

January 6, 2023

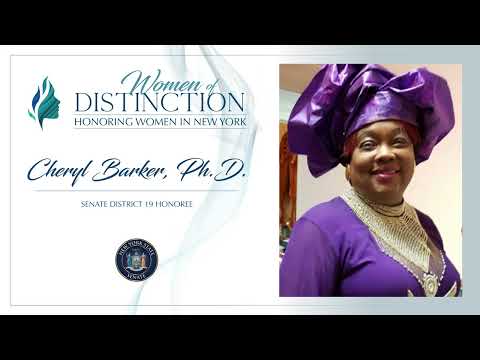

Senator Persaud 2022 Woman of Distinction

August 26, 2022