Senator Andrew Gounardes and Assemblymember Michael Cusick Introduce Property Tax Circuit Breaker to Help Low- and Middle-Income New Yorkers

January 24, 2020

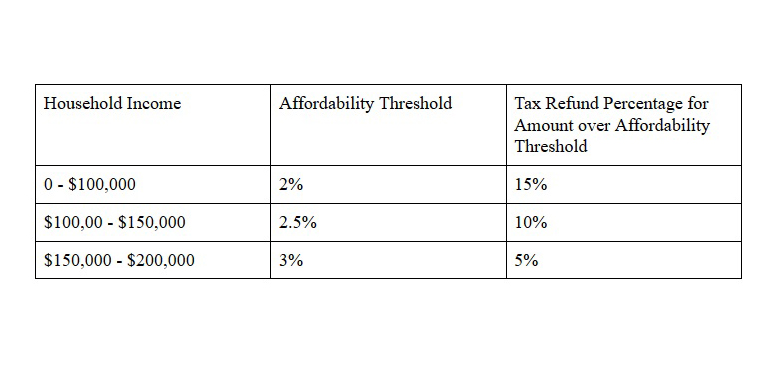

Brooklyn, NY -- Senator Andrew Gounardes and Assemblymember Michael Cusick today introduced a circuit breaker bill to provide property tax relief to low- and middle-income homeowners and renters in New York City. The circuit breaker legislation dictates that if a New York City taxpayer's property tax bill or Real Property Tax equivalent for renters is over a certain percentage of household income (the “affordability threshold”), they will receive a benefit percentage of the amount over the threshold back as a tax refund.

The breakdown is as follows:

This represents a significant increase over the recently-expired “NYC enhanced” circuit breaker. New York first created a statewide circuit breaker tax credit in 1985, but it applied only to gross household incomes of $18,000 or less and for real properties worth $85,000 or less. In recognition of the extremely limited nature of this credit, the legislature enacted an NYC enhanced circuit breaker in 2014, which expired on January 1st, 2020.

Senator Gounardes has also introduced S5234B to eliminate the cap on assessed value for homes worth $3 million or more when the household income is over $250,000.

“In a fair system, the very wealthiest New Yorkers wouldn’t get a special loophole, while senior citizens and working people struggle to get by. Park Slope shouldn’t pay less than Bay Ridge,” said Senator Andrew Gounardes. “A circuit breaker is designed to prevent damage from an electrical system becoming overloaded. Right now, New Yorkers are overloaded and need relief.”

"This legislation will help everyday folks across the city, including my constituents in Staten Island, who are struggling to afford the basics under some of the highest property taxes in the nation. I believe this is a strong first step towards a more equitable property tax system in the city,” said Assemblymember Michael Cusick.

New York City’s property tax system has long been considered by experts to require reforms for fairness and transparency. A New York City Advisory Commission on Property Tax Reform, empaneled in 2018 by the Mayor and Speaker of the City Council, is overdue to provide recommendations for reform, which would then need to pass as City or State laws.

###

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomBay Ridge hurts most in loss of flagship retailer Century 21

December 21, 2020

State Senator Andrew Gounardes Urges No MTA Fare or Toll Hikes

December 15, 2020