Senate Passes Eleven Bills Introduced by State Senator James Sanders Jr. This Week

July 24, 2020

Senator James Sanders Jr. (D-Rochdale Village, Far Rockaway) had eleven bills that he authored pass the senate this week. The legislation covers a variety of issues including unemployment, education, domestic violence, mental health, consumer protections, property sales and foreclosure mitigation, but all aim to improve life for the residents of the 10th Senatorial District as well as the entire State of New York.

The bills are listed below:

S.2231 - passed both houses - To ensure that unemployment insurance claimants providing child care for their children are able to satisfy the standards for proof of work search efforts.

S.8723 - passed both houses - The water works corporation must provide the annual water supply statement to its customers annually by either mailing it to a customer or publishing it in a newspaper of general circulation in the area served by the water works corporation. This bill would further require that the annual water supply statement be posted either on the water works corporations website or the website of the municipality in which the water works corporation serves. Posting this information on-line will give residents further opportunities to find information on the quality of their drinking water.

S.8761 - This bill will require a lender to appoint to the borrower one contact person who will be responsible for all communications with the borrower and who will be responsible for the entire process. Having one person responsible will make it less likely that a borrower who is trying to save his or her home will fall victim to the bureaucracy of the foreclose mitigation process and of the very large mortgage servicers.

S.1446 - To ensure that a buyer or buyer's agent receives information regarding the indoor mold history of a property prior to the sale of said property.

S.7117 - passed both houses - supported by NYSUT - Relates to the cumulative grade point average admission requirement for graduate-level teacher and educational leader programs. Prior to the enactment of provisions contained in chapter 56 of the Laws of 2015, higher education institutions had the full discretion and autonomy to consider multiple measures when determining whether or not to admit a student into their graduate-level and educational leader programs. The requirement that a student have an overall GPA of 3.0 is a one-size fits all policy that prohibits educational institutions from applying discretion to identifying an individual's potential quality as a future teacher. This legislation will provide higher education institutions with more discretion through the expansion of criteria to be used when considering whether or not to admit a student into their program.

S.2224-B - (endorsed and a priority bill of the New York State Coalition Against Domestic Violence) - Establishes that domestic violence advocates may not disclose any communication made by a client to the advocate except in certain circumstances

S.2106-A - This bill would require banks to inform customers of any consequences to their credit score when the bank has agreed to an alternative payment schedule.

S.2475 - To update the computer-related crimes provisions of the law. In today's world of cyber terrorism and technological warfare, it is essential to modernize the state's computer-related crimes law. This includes establishing definitions of terms, expanding provisions, establishing more specific offenses and providing civil remedies.

S.2248-A - To create a veterans' mental health and suicide prevention task force.

S.2088 - No mortgage banker, mortgage broker or exempt organization shall conduct business with any person, partnership, association, corporation or other entity which it knows or should have known is acting as a mortgage banker or a mortgage broker without being licensed or registered as required by this article. A mortgage banker, mortgage broker or exempt organization shall promptly notify the department of any such unlicensed or unregistered operations

S.4652 - This bill will require standard financial aid award letters to include the estimated cost of repayment of all outstanding loans including expected monthly payments. Debt from student loans has continued to grow over the last two decades with an estimated $1.3 trillion in outstanding debt. The enhancements to annual financial aid award letter will provide students with detailed information on their repayment including the estimated monthly payment amount. The goal is to better educate students so they are prepared for the debt burden after they graduate. A similar program was started in Indiana University and resulted in a decrease in student borrowing of 16% in the first two years of implementation. This additional information will help students make informed decisions on their borrowing behavior by estimating their repayment options.

Share this Article or Press Release

Newsroom

Go to Newsroom

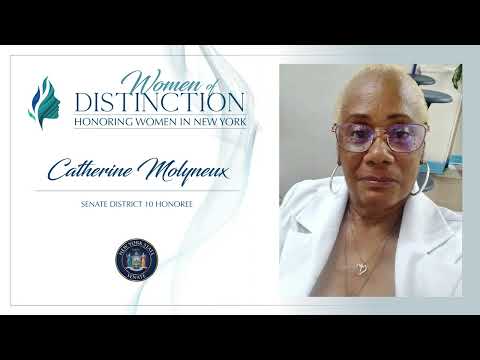

Senator Sanders 2022 Woman of Distinction

August 26, 2022

2022 Queens Carnival Promo Video

August 9, 2022