Senator Sanders Hosts Latest in a Series of Economic Development Events, This Time Focusing On Access to Capital

July 30, 2020

As Queens begins to adjust to the new normal post-COVID-19, there is still uncertainty about how to rebuild the economy. Under those conditions, Senator James Sanders Jr. (D-Rochdale Village, Far Rockaway) hosted the latest in a series of economic development webinars on July 27, 2020 on Facebook Live, bringing together some of the top lending institutions to explore how aspiring entrepreneurs and business owners can access real capital and more.

“When you think about all of the opportunities out there, you can really take a small loan and turn it into something great,” Sanders said. “We are here to inform small businesses and aspiring entrepreneurs alike how they can get access to that vital capital to make their dreams come true.”

The event featured the following guest speakers: Seven Garibell, Vice President, LGBTQ + Business Development, TD Bank; Marian Cicolello, Director, NYC Business Solutions / Small Business Services; Paula Libreros, Senior Account Manager, NYC Small Business Solutions; Paul Quintero, CEO Accion East; and Steven Cohen, President, Pursuit Community Finance.

NYC Small Business Solutions offers many resources free of charge. These include business courses that can help you develop your business and give you guidance on the right strategy moving forward. Although the agency does not lend money, it can connect businesses with government incentives that can help them save money and give them a competitive edge.

SBS also provides trainings to give employees new skills in order to elevate businesses, as well as provides legal assistance, connecting businesses with pro-bono lawyers that can answer their legal questions. SBS helps cut through the red tape and assists businesses in navigating government, provides assistance for those interested in becoming a government contractor, and boosts recruitment, meaning they help businesses hiring new staff to open a new location or expand an existing business. In addition, SBS aids with MWBE certification. Certification helps businesses compete for government contracts and gives them access to exclusive programs designed to help small businesses grow.

Steven Cohen, President, Pursuit Community Finance, spoke about the New York Forward Loan Fund, a program organized by New York State to help small businesses that are having some capital challenges and it can be of great assistance for businesses impacted by the COVID-19 pandemic. Two of the lenders for the fund are Accion and Persuit. The terms of the fund are as follows: You can apply for up to $100,000 or up to 100% of your average monthly revenues for a 3-month period prior to the COVID-19 outbreak, whichever is lower. The term is 5 years. For the first year, the business makes monthly interest-only payments and will make principal and interest payments for the rest of the term. It is a 3% fixed interest rate and there are no fees. Businesses that have not received federal relief loans (EIDL/PPP) can get three times their average monthly revenue by getting matched with a lender through NY.LoanFund.com

Accion East, one of the New York Forward Loan Fund lenders, focuses on microloans that are locally based but have national reach. They have had a proven impact on people’s lives, according to their CEO, Paul Quintero, increasing financial stability, creating good jobs and long-term business success. They offer COVID-19 specific help with SBA PP Loans, New York Forward Loans, Miami RISE Loans and SBA Microloans as well as their regular offerings of core microloans, home-based childcare loans, and SBA Community Advantage. Later this fall, Accion East will offer restaurant industry loans and lines of credit.

This economic development event was one of a series of similar webinars that Senator Sanders is hosting to empower the community to take ownership in their neighborhoods and build generational wealth.

.

Share this Article or Press Release

Newsroom

Go to Newsroom

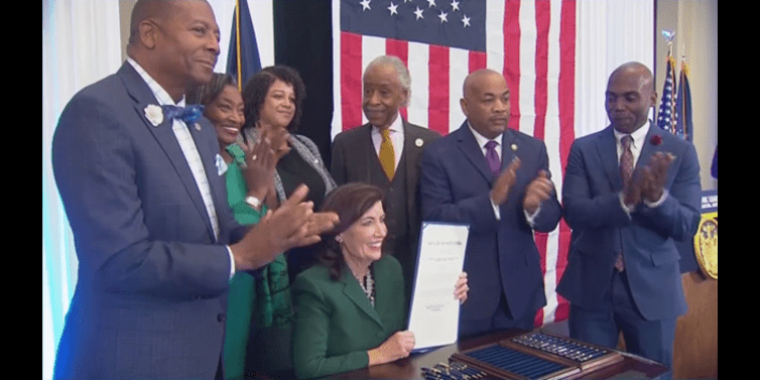

Sanders Scores Wins for MWBEs with Hochul Signature

December 18, 2023

Governor Hochul Signs Sanders' Sickle Cell Bill.

December 13, 2023