Providing Relief for Farmers, Senator Jen Metzger Introduces Bill Doubling Farm Workforce Retention Credit

January 6, 2020

-

COMMITTEE:

- Agriculture

Albany, NY…Senator Jen Metzger (SD-42) announced today a new bill she has introduced to increase the Farm Workforce Retention Credit from $600 to $1,200, allowing eligible farm employers to claim a refundable tax credit for each farm employee who works 500 or more hours each year. Under the current tax law, New York farmers received $500 per eligible employee in 2019, and would receive $400 in 2020 and $600 in 2021, at which point the existing law would sunset. Metzger's legislation would extend the tax credit indefinitely.

Metzger’s new bill would increase the tax credit from $600 to $800 starting January 1, 2021, and then double the credit to $1,200 per employee starting January 1, 2022. In addition to keeping many New York farms out of the red, the bill is intended to enhance New York farmers’ ability to attract and maintain skilled workers, instead of losing them to farms in nearby states.

"This legislation is significant and demonstrates that Senator Metzger understands what farmers need," said Chris Kelder of Kelder's Farm and District 10 Director of the New York Farm Bureau. "Those of us who work the land know that the margins are thin, and having this kind of support will go a long way to sustain our operations. Furthermore, it offers us additional incentives to hire and keep the farmworkers we need."

According to 2017 USDA-ERS data reported in the Farm Credit East Knowledge Exchange report, New York’s farm labor expense was approximately 13.2 percent of the value of agricultural receipts, compared to the national average of 9.5 percent.

“New York farmers contend with significantly higher labor and other costs than farmers in other states and internationally, making it very difficult for them to compete," said Senator Metzger. “As producers of commodities, farmers are price takers and are constrained in their ability to raise prices. We are very fortunate in New York to have an agricultural economy comprised primarily of small and mid-sized family farms that produce a rich diversity of products--an increasing rarity in an age of big, industrial agriculture. The proposed tax credit will provide needed relief, supporting this important sector of New York's economy and protecting our long-term food security.”

"I appreciate Senator Metzger's leadership on this vital issue of farm workforce retention," says Tom Bose Sullivan County farmer and Callicoon Town Supervisor. "For many farmers throughout New York State, finding, hiring, and keeping good farm labor is a matter of survival. Sustaining our family farms not only puts fresh food on our tables, it enriches our communities in so many ways."

Duane Martin, President of the Delaware County Farm Bureau and herdsman on family farm, Tylervale Farms, in South Korwright says, "I would like to thank and commend Senator Metzger for not only ending the sunset time limit of the Farm Labor Tax Credit but doubling it to help New York's struggling farmers. Agriculture is the heartbeat of economic activity in upstate New York, employing over 60,000 farm workers and an additional over 160,000 people in the farm service sector such as banking, farm equipment dealers, feed mills, auction barns and trucking, and also in the fruit processing and marketing sectors such as milk processing, transportation and retail. New York farmers are at a competitive disadvantage with farmers in neighboring states such as Pennsylvania and Ohio, and foreign farmers from Brazil and Mexico with lower labor costs. This bill significantly helps level the playing field."

Metzger anticipates Assembly Agriculture Chair Donna Lupardo to introduce the legislation in the Assembly.

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomLegal Services of Central New York: Renters Rights One-Sheet

September 19, 2019

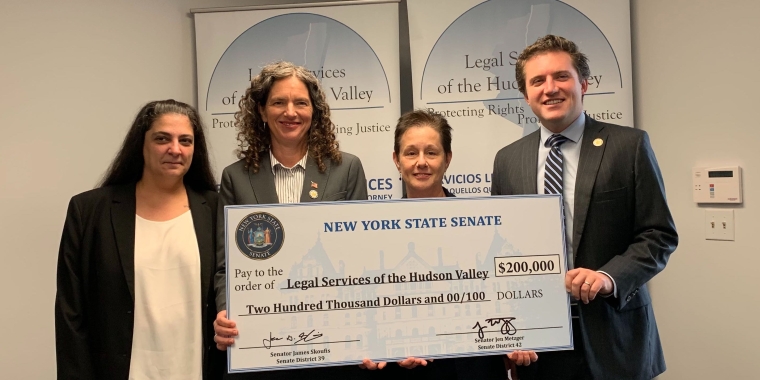

Legal Services of the Hudson Valley: New Rights for Tenants

September 19, 2019