Senator Thomas & Assemblyman Zebrowski’s Landmark Small Business Truth in Lending Act Signed into Law

December 24, 2020

-

COMMITTEE:

- Consumer Protection

(Garden City, NY) - Senator Kevin Thomas and Assemblyman Ken Zebrowski announced today that their Small Business Truth in Lending Act has been signed by Governor Cuomo into New York State Law (A10118A/S5470B). The law institutes unprecedented transparency in the commercial financing industry by requiring basic, uniform disclosures for non-bank commercial lenders. Currently, there are no disclosure requirements for commercial borrowers under state or federal law; unlike consumer borrowers who are protected under the federal Truth in Lending Act (TILA). The Zebrowski/Thomas measure will require this disclosure on the terms and cost of financing which is necessary for business owners to compare different commercial loan products. As many small businesses continue to face enormous challenges amid the COVID-19 pandemic, these protections are necessary for those seeking financing moving forward.

Non-bank commercial lenders have proliferated in New York State in recent years, providing small businesses with lending products that have widely varying disclosures on interest, cost, and fees. The inconsistency within the industry makes it difficult for small business owners to shop around for different products and can ultimately lead to a cycle of debt. Lenders are vastly different in what they disclose - some providing very little information and others using different metrics. Many small business owners do not have the financial background to interpret technical financial language regarding pertinent information such as cost and fee terms.

This legislation is the culmination of nearly a year of input and constant conversation with various stakeholders including non-profit lenders (CDFI organizations), a diverse set of commercial lenders, small business advocacy groups and other groups dedicated to transparency in lending.

Under the bill, the uniform disclosure requirements will apply to all types of commercial financing and provide the small business borrowers with the: cost of financing, /actual/estimated Annual Percentage Rate (APR), payments, prepayment penalties and any other potential fees. All required disclosures must be provided to the business owner prior to entering into a contract.

“The signing of the New York State Small Business Truth in Lending Act is a victory for New York’s small business owners. This law will help protect the small businesses in our state by bringing much-needed transparency to commercial lending and making it easier than ever before for business owners to compare financing options. Thank you Governor Cuomo for signing New York’s first-ever small business lending transparency bill into law. New York State continues to lead the way in protecting small businesses during this public health crisis,” said Senator Thomas.

“Now more than ever, we must be supporting and providing our small businesses with every tool possible to succeed and recover from the COVID-19 pandemic. A lack of uniform disclosures has led to a confusing and complex environment for business owners accessing commercial financing.This legislation will provide clarity through a simple and easily understood disclosure that provides information on the true costs and hidden fees of an offer. A simple and understandable disclosure will level the playing field and ensure business owners are making an informed decision that is best for their business,” said Assemblyman Zebrowski.

""First and foremost, thank you to Chairman Zebrowski, Chairman Thomas, Governor Cuomo and the Department of Financial Services for their hard work in enacting the most robust small business finance disclosure law in the country. Small business owners deserve to see, understand, and compare the exact terms, costs, and payments of the product they're considering. Greater transparency will create more competition, better options and lower costs for small businesses. ” said Innovative Lending Platform Association (ILPA) CEO Scott Stewart.

“The NYS Small Business Truth in Lending Act will bring common-sense transparency standards to small business financing at a time when it’s needed most. Community Development Financial Institutions are committed to offering loans in a fair, affordable and transparent manner. Unfortunately, some lenders have made it hard for small businesses to compare the true cost of their offers, and this bill will give borrowers access to the information they need to make good financial decisions. CDFI Coalition members around the state applaud Assemblyman Zebrowski for his leadership on this important issue and thank Governor Cuomo for signing this bill into law,” said Linda MacFarlane, chair of the NYS CDFI Coalition.

“The UpState New York Black Chamber of Commerce would like to thank Assemblyman Zebrowski and his dedicated staff for their commitment to business owners throughout New York State, especially the Black and minority business owners who will most benefit from the protections provided by the NYS Small Business Truth in Lending Act. This legislation is yet another example of the leadership and influence that is New York State. Thank you to the Assemblymembers and Senators who also supported this important moment in the history of our great state,” said Anthony Gaddy, Co-Founder/President and CEO.

"This new law brings common-sense transparency standards to small business financing in New York, marking the strongest commercial lending disclosure law in the nation. Under this law, the Responsible Business Lending Coalition expects New York small businesses to save between $369 million and $1.75 billion annually. We are grateful for Assemblyman Zebrowski standing up for small businesses, especially as so many struggle through this pandemic," said Ryan Metcalf, Responsible Business Lending Coalition Spokesperson and Head of Regulatory Affairs for Funding Circle U.S.

Share this Article or Press Release

Newsroom

Go to NewsroomNew York Lawmakers Look to Fortify Critical Infrastructure

August 26, 2021

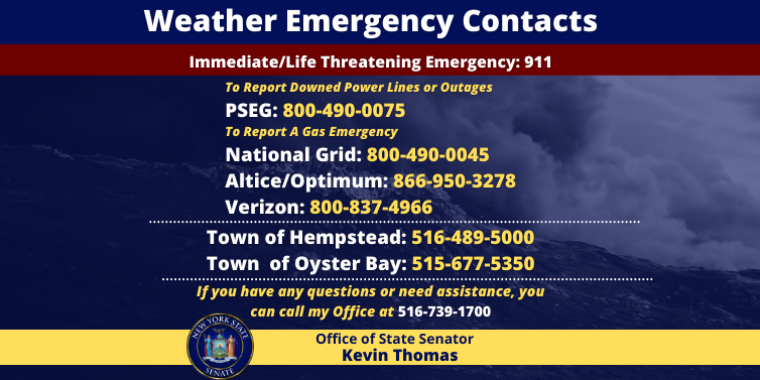

Weather Emergency Resources

August 20, 2021