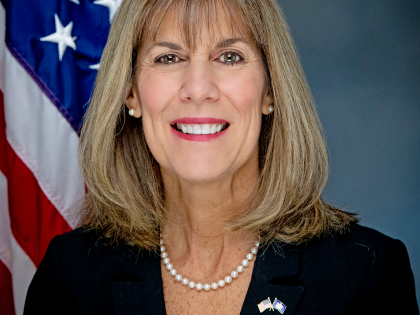

Senator Daphne Jordan and Senate Republicans: Fix New York's Broken Unemployment System Now

Sen. Daphne Jordan

May 4, 2021

ALBANY, NY – Senator Daphne Jordan (R,C,I-Halfmoon) and her Senate Republican colleagues today called on the State Legislature and Cuomo administration to fix multiple issues that continue to plague New York’s broken unemployment system, as well as enact measures to provide relief to New Yorkers who continue to struggle as a result of the pandemic.

More than a year after millions of New Yorkers were put out of work due to the pandemic and COVID-related restrictions, there continues to be a multitude of technical issues with the state unemployment system. In addition, several proposals to provide additional relief for struggling New Yorkers who often couldn’t access their benefits for months at a time have been stymied or ignored.

On April 22, 2021, Senator Jordan wrote to the State Labor Commissioner outlining several concerns regarding the State Department of Labor’s continued inability to provide timely responses to Unemployment Insurance inquiries, as well as the Department’s failure to effectively curtail rising cases of Unemployment Insurance fraud resulting in New Yorkers being denied rightful claims. Senator Jordan’s correspondence is attached with this news release.

Specifically, Senator Jordan and her Senate Republican colleagues are calling for:

- A complete, forensic audit of the state’s IT systems to identify failures and weaknesses, and to strengthen the digital infrastructure to avoid future catastrophic failures in the future; and

- An accurate and honest assessment of potential fraud and efforts to recoup it, particularly as the state’s unemployment insurance fund is facing a $10 billion deficit, leading to dramatic increases in costs to our small businesses.

“I find it inexplicable – and frankly inexcusable – that more than a year into the COVID-19 pandemic, and with an annual appropriated operating budget of nearly $1.8 billion, that the State Department of Labor remains unable to provide a timely, informed response to New Yorkers that have made inquiries and requested the Department’s assistance. Some of my constituents have waited, and are still waiting, weeks for a response from the Department. My office continues working hard to help constituents and ensure they receive a timely response from the Department of Labor that addresses their concerns,” Senator Jordan said.

“My office has also received multiple notices from municipalities, businesses, and individuals across my 43rd Senate District citing instance after instance of fraudulent Unemployment Insurance claims being filed. In fact, one current Town Supervisor and a former elected official in my Senate District shared that Unemployment Insurance paperwork recently arrived for their signature and that the paperwork, which was filled out in their names, listed their personal information. Constituents have also contacted my office sharing that when they finally received a response from the State Department of Labor and were able to file an Unemployment Insurance claim, it was denied because a fraudulent claim had already been falsely filed in their name. The State Department of Labor needs to respond to all of these serious concerns and fulfill its mission of serving New Yorkers and helping those in need,” Senator Jordan stated.

In addition, Senator Jordan and her fellow Senate Republicans are calling for action on measures to provide immediate, financial relief to struggling New Yorkers, including:

- A state tax break of up to $10,200 on unemployment benefits collected during the pandemic last year, which would be in line with recently enacted federal exemption; and

- A one-time forgiveness for unemployment overpayments, which the state Department of Labor is currently trying to claw back from struggling New Yorkers.

In the last COVID stimulus package, the federal government waived federal tax on up to $10,200 of 2020 unemployment benefits for households earning up to $150,000. Although states were afforded the same option to exclude unemployment benefits from taxable income, New York has so far declined, and is one of only 11 states to not take advantage of this significant tax break as the May 17 filing date fast approaches.

To add to the uncertainty of many New Yorkers who collected unemployment, recent reports, and constituent calls from around the state signify the state Department of Labor is in the process of clawing back thousands of dollars in “overpayments.” One email provided by a constituent suggested the Department of Labor’s “internal review process identified a group of roughly 166,000 New Yorkers who received one or two duplicate payments, which total approximately $145 million.”

New York’s broken unemployment system has also negatively affected the small business community throughout the state, as the current $10 billion hole in the unemployment insurance fund has already sent premiums skyrocketing, furthering the closure and/or relocation of even more jobs and job creators. The substantial increase in unemployment insurance rate hikes for New York businesses comes after the State Legislature and Governor passed into law a measure that was supposed to keep COVID-related closures from affecting a business owner’s experience rating. Unfortunately, the bill did not prevent the state from raising rates to replenish the fund.

Editor’s Note: Attached with this news release is a copy of Senator Jordan’s recent correspondence to the State Department of Labor.

###

Share this Article or Press Release

Newsroom

Go to NewsroomIchabod Crane Basketball Champs

May 27, 2022