Governor Hochul Signs Consumer Credit Fairness Act Into Law

November 9, 2021

-

COMMITTEE:

- Consumer Protection

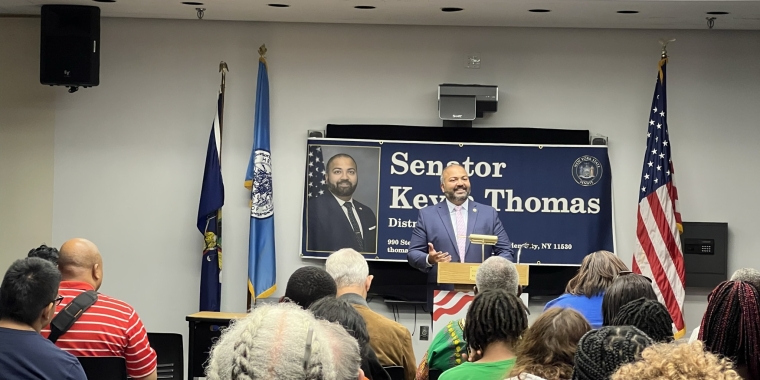

(Albany, NY) — Governor Kathy Hochul yesterday evening signed the Consumer Credit Fairness Act (S.153/A.2382) to protect vulnerable New Yorkers from predatory and unscrupulous debt collection practices. The legislation was sponsored by Senator Kevin Thomas (D-Levittown), who Chairs the Senate Committee on Consumer Protection, and Assemblymember Helene Weinstein (D-Brooklyn).

The Consumer Credit Fairness Act (CCFA) strengthens consumer protections in debt collection proceedings by:

- Requiring a notice to be mailed to the defendants in consumer credit actions by the clerk of the court, ensuring that defendants are given notice of the lawsuit;

- Requiring court filings to include more information about the debt targeted in a lawsuit, such as identifying the debt or account and providing proof that the debt is owed to the plaintiff;

- Lowering the statute of limitations for consumer credit transactions from six years to three years, compelling creditors to file claims in a timely manner and protecting consumers from excessive interest charges and late fees;

- Establishing specific requirements for applications for default judgments in consumer credit actions to prevent debt buyers from suing on expired debt.

Senator Kevin Thomas said, “Abusive and exploitative debt collection lawsuits have become an epidemic across New York State. The consequences of these lawsuits—which often prey on the elderly, disabled, and low and moderate income New Yorkers—are devastating, especially at a time when New Yorkers are already suffering financial difficulties as a result of COVID-19. The Consumer Credit Fairness Act will stop these abusive and often illegal debt collection practices in their tracks. I want to thank Assemblymember Weinstein and our hardworking consumer advocates for their partnership, and Governor Hochul for standing up for New York consumers by signing the CCFA into law.”

Assemblymember Helene Weinstein said, “My legislation will protect consumers from unfair credit card collection practices by debt collectors. Too many improper judgments have been obtained against unsuspecting consumers who have done nothing wrong, and it is time to add teeth to the law to prevent these kinds of debt collection abuses from occurring. I thank the Governor and Senator Thomas and all the consumer advocates who stayed the course through the years for partnering with me in getting these much needed reforms to our laws enacted.”

Carolyn Coffey, Director of Litigation for Economic Justice at Mobilization for Justice, a member of New Yorkers for Responsible Lending, said, “The Consumer Credit Fairness Act levels the playing field for the thousands of New Yorkers sued in debt collection cases who cannot afford an attorney, including consumers of color who are disproportionately targeted for debt collection. We applaud the Legislature and Governor Hochul for enacting this important legislation, which closes gaps in existing laws that allow bad actors to benefit from abusive practices, and will help consumers facing the devastating financial consequences of the COVID-19 crisis.”

Gina Calabrese, Professor of Clinical Education at St. John’s University School of Law said, “CCFA is the long-needed relief for financially-stressed New Yorkers who have been taken to court by debt collectors pursuing spurious lawsuits to collect credit card debts and other debts. CCFA will stop debt collectors from exploiting loopholes in our court procedures that they’ve used to turn our courts into debt collection machines. Many thanks to Assemblymember Helene Weinstein for her leadership and perseverance on CCFA over many years, to Senator Kevin Thomas for championing the bill in the Senate, and to Governor Hochul for signing it into law. With CCFA, these leaders have delivered relief to countless New Yorkers who would have been burdened by non-meritorious collection cases for decades to come.”

Elizabeth Perez, Staff Attorney at DC 37 Municipal Employees Legal Services and Co-chair of the Consumer Finance Working Group for New Yorkers for Responsible Lending said, "As a statewide coalition committed to promoting access to fair and affordable financial services and to the preservation of assets for all New Yorkers, we at NYRL applaud the passage of the Consumer Credit Fairness Act. This important legislation will greatly reduce the number of unfair and abusive debt collection lawsuits, which are particularly harmful to New Yorkers who are elderly, disabled, low and moderate income, or domestic violence survivors. The Act will directly help ensure basic standards of fairness are applied in the numerous anticipated collection lawsuits that will be filed as a result of the COVID-19 crisis. We especially thank Senator Thomas and Assemblymember Weinstein, for their dedication to getting this legislation passed!"

Encore Capital Group said, “Encore Capital Group appreciates the work Senator Thomas and Assemblymember Weinstein did to engage all stakeholders and reach a compromise bill that creates significant changes in NY State’s collection law.”

Receivables Management Association International said, “The Receivables Management Association International appreciated the opportunity to work with Senator Thomas, Assemblymember Weinstein, consumer advocates, and industry stakeholders to strengthen consumer protections involving consumer credit transactions. This law exemplifies what can be accomplished when folks come to the table willing to work together to solve a common concern.”

###

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom

Blue skies, fun rides, songs and waffles

June 9, 2022