NY Lawmakers Urge Inclusion of Expanded Earned Income Tax Credit in Final Budget

Senator Anna M. Kaplan

March 10, 2022

Albany, NY (Mar. 10th) — Assemblymember Patricia Fahy and Senator Anna Kaplan today urged the inclusion of an expanded New York Earned Income Tax Credit (EITC), proposed in A.2533/S.537, as part of New York’s final fiscal plan for FY2022-23. The federal EITC and its New York State counterpart have been among the most successful poverty alleviation programs in the nation. This proposal builds on the success of the New York EITC by increasing the value of the credit, expanding eligibility for the credit, and creating an option for recipients of the credit to receive advance payments quarterly.

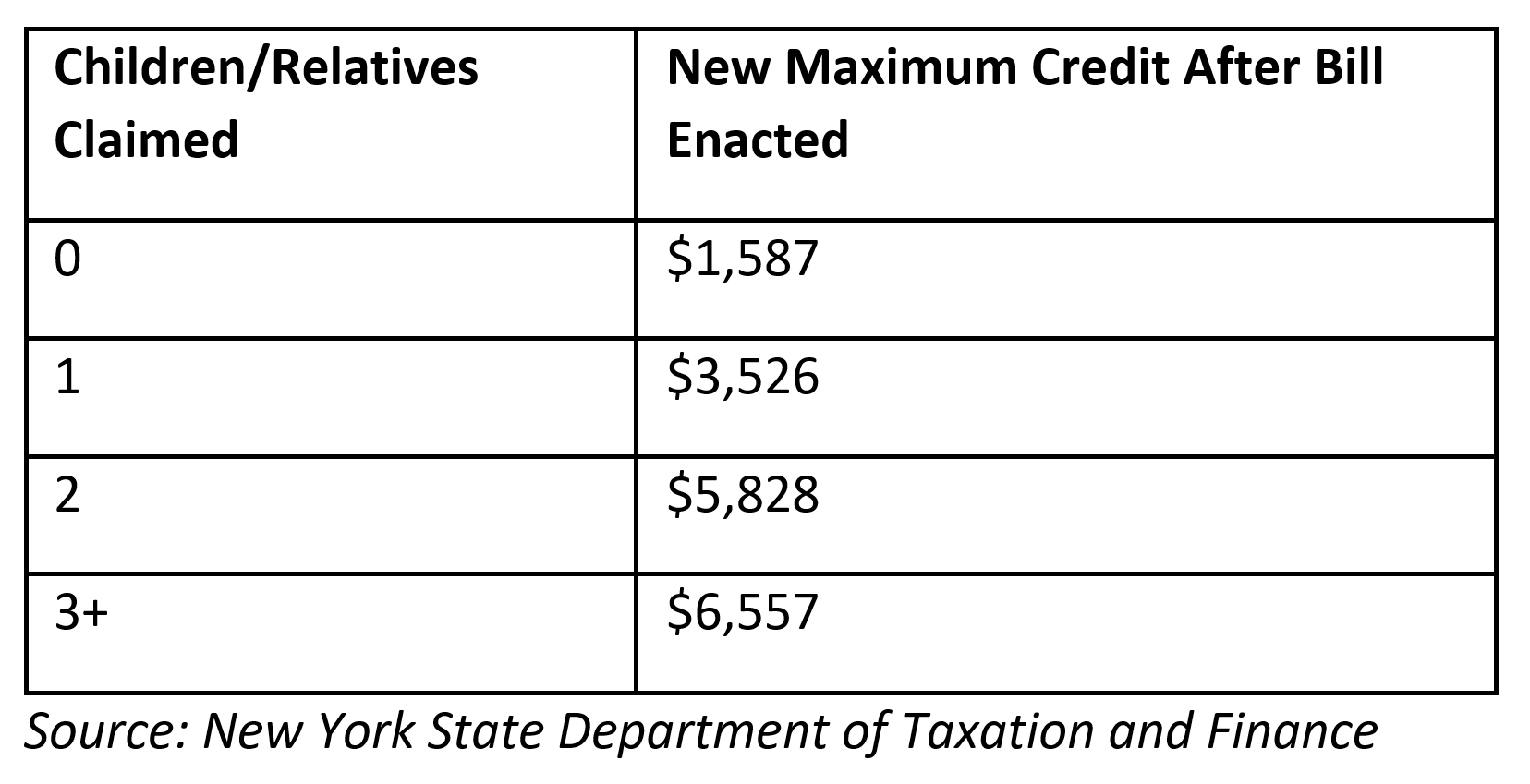

In addition to expanding NY’s EITC eligibility by raising income phase-out limits, this bill also expands eligibility for the credit to those who do not have children, those aged 18-24, and those who file income taxes without a Social Security Number. The phase-out start point would grow from $8,790 to $24,960 for childless adults and single parents, and from $14,680 to $29,960 for joint filers. This bill also raises the total value of NY's EITC from 30% to 40% of the federal EITC. Filers would see the following increased state credits:

Decades of research have shown that EITC and other tax credits are some of the most successful poverty-reduction programs that simultaneously encourage individuals to enter the workforce, lifting 5.6 million Americans out of poverty in 2018 alone. In 2020, 1.2 million New Yorkers alone claimed the state EITC, illustrating the breadth of its impact.

“The earned income tax credit is one of our most proven social mobility tools in lifting individuals and families out of poverty,” said Assemblymember Patricia Fahy (D—Albany). “By expanding New York’s EITC eligibility, increasing credit amounts, and authorizing advance payments for filers, we’re ensuring that low-income New Yorkers aren’t left behind in our recovery from the COVID-19 pandemic. When we talk about jumpstarting an equitable and just economic recovery, improving New York’s EITC is one of the most effective ways to ensure that becomes a reality.”

“When we talk about ensuring that no New Yorker is left behind in our economic recovery from the pandemic—we need to act for those words to have meaning,” said Senator Anna M. Kaplan (D-North Hills). “Expanding New York’s Earned Income Tax Credit is one of the most effective ways to lift families and individuals out of poverty, while encouraging more and more New Yorkers to enter and participate in the workforce. Given the temporary increase in the federal earned income tax credit was only for tax year 2021, it makes sense to continue that progress here in New York and ensure that hard-working families in our community aren’t forgotten amidst our economic recovery.”

"Expanding the Earned Income Tax Credit (EITC) is an important step toward lifting working New Yorkers out of poverty,” said Assemblymember John T. McDonald III, RPh. “The EITC is a resource for low wage earners and advances equity in our communities. Thank you to Assemblymembers Fahy and Kelles for leading this effort to include an expanded EITC in the Assembly one-house budget and I am glad to support this effort that will lift up our working families."

“We need tools to fight poverty, and the Earned Income Tax Credit (ETIC) is one of the best tools we have,” said Assemblymember Harry Bronson (D – Rochester, Henrietta and Chili). “Working families and individuals need support now. Expanding the ETIC is critical to helping more New Yorkers during these turbulent economic times. We must include the expanded EITC in the final budget if we want an equitable and inclusive recovery from COVID-19.”

“We saw how successful tax credits have been helping lift families out of poverty,” said Assemblymember Jennifer Lunsford. “This expansion of the earned income tax credit will continue that good work by putting more money back into the pockets of low-income families who are struggling to put gas in their cars and food on their tables.”

“Expanding the earned income tax credit is a cost-effective plan to help lift people out of poverty,” said Assemblymember Chris Burdick. “As those most in need rise out of poverty, they are better able to put food on the table, pay rent and avoid homelessness. At this critical time in our collective recovery from the pandemic, we need to do everything we can to make sure that people aren’t left behind.”

"In a time of unprecedented economic volatility, New York State has the power to uplift tens of thousands out of poverty by making these bold and necessary enhancements to the state's Earned Income Tax Credit,” said Assemblymember Fred Thiele. “I'm proud to join my colleagues in calling for this credit to better serve our constituents and provide much-needed financial relief."

###

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomInformation about at-home COVID rapid tests

April 4, 2022

Legislators Propose Public Talks To Fill Vacancies

March 31, 2022

West Point Cadet From Port Washington Honored In Albany

March 30, 2022