Tedisco and Jordan: Cap Gas Tax, Then Suspend It “Why Wait Until Gas Prices Hit $4 Per Gallon?”

March 27, 2022

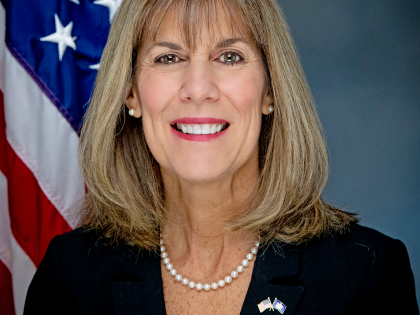

As high gas prices continue to drain the wallets of New Yorkers with no end in sight, Senator Jim Tedisco (R,C-Glenville) and Senator Daphne Jordan (R,C,I-Halfmoon) today announced a new solution to help ease the pain at the gas pump and provide long-term peace of mind from future inflationary spikes in gas prices. Senator Tedisco and Senator Jordan are introducing new legislation to start to cap the state gas tax at $2.25 per gallon and suspend it fully at $3.00 per gallon in perpetuity or until it goes back below $3.00.

Tedisco and Jordan also are advocating their proposal as a solution to be part of state budget talks to help provide relief to New York motorists from the cost of high gas prices.

Instead of waiting until gas prices hit $4.00 per gallon to take action, Tedisco and Jordan’s plan fights inflation and attacks it at the gas pump by starting to suspend the state’s portion of the gas tax when the price of gas reaches $2.25 per gallon.

Tedisco and Jordan’s bill phases-in the suspension and would fully suspend state taxes when and if a gallon of gas reaches $3.00. The state’s portion would continue to be suspended until the price reaches back down to the $3.00 mark and is only fully implemented at $2.25 per gallon.

Long before gas prices reach $4 per gallon, taxpayers would save 33 cents per gallon when fully implemented under Tedisco and Jordan’s legislation. Their bill, which is being drafted, also would direct all future gas tax funds to a state infrastructure fund for our state roads and bridges once gas prices go back below $3.00 per gallon.

“It’s cold comfort for taxpayers for New York State government to try to fight inflation at the pump by waiting for a gallon of gas to cost $4.00 and only then suspending a portion of the gas tax for a brief period. Inflation should be stopped in its tracks as it begins to move gas prices upward starting at and capping at $2.25 per gallon by then continuing to reduce the gas tax to keep the price there until it reaches $3.00 per gallon and then keep the state’s portion of the gasoline tax fully suspended until the cost goes back down to $2.25! Our cap and suspend plan will give inflation relief while prices begin to rise and continue until inflation abates and prices go back down to a more reasonable range,” said Senator Jim Tedisco.

“Our legislation to cap and suspend the state gas tax is a win-win for taxpayers, small businesses, and New York State’s coffers because people will have more money to spend helping our economy and contributing more sales tax revenue for our local governments through the purchase of goods and services,” said Tedisco.

“Gas prices are at record highs and New York families are bearing the brunt and feeling the pain — serious pain that demands fresh ideas and real relief, not half measures. Folks shouldn’t have to take out a second mortgage just to fill their tank so they can get to work, take the kids to lessons, or drive to the grocery store. People are spending $75, $80, even more every fill-up. The gas price sticker shock is bad and it’s only getting worse. Our new legislation represents a new approach and a smart solution to this growing problem by suspending a portion of the state’s gas tax when the price of gas reaches $2.25 per gallon, continuing a further suspension of the tax in increments until a full suspension is reached when a gallon of gas costs $3. Our bill also ensures our roads and bridges aren’t shortchanged as it directs all future gas tax funds to a state infrastructure fund once gas prices go back below $3 per gallon. This new legislation is thoughtful, comprehensive, and a smart solution to our gas price crisis. Our bill should be part of the final 2022-23 State Budget so New Yorkers can finally see that some real help is on the way,” Senator Daphne Jordan (R,C,I-Halfmoon) said.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Daphne Jordan advocates for landlords

June 17, 2021

A Better New York

June 11, 2021