Senator James Sanders Jr. Fights for Community Needs as New York Senate Passes "Best Budget Proposal Ever" One-House Budget Resolution

March 16, 2022

Today State Senator James Sanders Jr. along with the Democratic Majority of the New York State Senate passed the one-house budget resolution which Sanders called the "best ever" and outlines the priorities the conference will set forth during budget negotiations with the Governor with hopes that they be included in the final state budget that must be passed by the April 1, 2022 deadline.

Senator Sanders continues to work diligently to fight for the needs of his district and spearheaded numerous measures, which he believes are of major importance to the community. They include funding to support education as well as housing assistance.

Just some of the provisions that directly impact the 10th Senate District include:

● The budget proposal provides up to $1 billion for the Emergency Rental Assistance Program (ERAP) and promotes fair distribution of pending federal dollars.

● Restores $250 million in Landlord Rental Assistance Program (LRAP) funding, and adds an additional $250 million for LRAP.

● Provides $250 million in new support for Universal Pre-Kindergarten with full phase-in of full day 4-year old pre-k in two years.

● Keeps New York on track to fully phase in Foundation Aid by 2023-24 -- the main source of state funding for public schools.

● Provides $1 billion for assistance to financially distressed or safety net hospitals, like St. John's Episcopal Hospital.

Provisions Senator Sanders spearheaded include:

- Supported and amended the $200 million for the Small Business Seed Funding Grant Program. The Senate modifies the Executive Small Business Seed Funding Grant Program to expand the eligible businesses to include closed businesses that can show COVID-19 expenditures related to their closing.

- Adds $2 million in additional support for the Minority and Women-Owned Business Development and Lending Program, for a total of $2.6 million.

- Includes $3 million for Education Debt Consumer Assistance Program.

- Provides a credit for businesses replacing heating systems to geothermal or biofuels.

- Includes Community Development Financial Institutions (CDFI) in the Linked Deposit Program to specify that such CDFIs must also meet the requirements of the New York State Community Reinvestment Act.

"I am fully dedicated to the needs of my community and the betterment of the entirety of New York State," Sanders said. "Now is the time that I stepped up to the plate and let the Governor know what's important to the people of the 10th District and bring home the resources that we so desperately need, especially as we try to recover from the damage caused by the pandemic."

Senator Sanders also strongly supported these other measures listed below to be in included in the final state budget.

INVESTING IN EDUCATION AND HIGHER EDUCATION

● $1.1 Billion for the SUNY/CUNY “New Deal” to support the hiring of full time faculty,

close the TAP Gap, increase adjunct pay and eliminate student fees.

● Doubles the Executive proposal for Mental Health funding from $100 million to $200 million.

● Increases the income threshold to qualify for TAP from $80,000 to $110,000 and increases the minimum TAP award from $500 to $1,000.

SUPPORTING HEALTH AND MENTAL HYGIENE

● Provides an additional $345 million to expand the Essential Plan to all uninsured individuals under 200 percent of the Federal Poverty Level who would otherwise be eligible except for their immigration status.

● Fair Pay for Home Care Act which raises the minimum wage for home care workers to 150% of the regional minimum wage, and increases the reimbursement to home care agencies and fiscal intermediaries.

● Provides an additional 5.4% COLA in the next state fiscal year for human services workers, and an additional 5.4% COLA in year two.

● Expands eligibility to the Essential Plan by allowing undocumented immigrants to enroll in the plan. During the pandemic, it is important that everyone has access to healthcare because COVID is an infection disease.

BUILDING STATE OF THE ART TRANSPORTATION

● In addition to the Executive’s $4.8 billion of transportation funding, the Senate adds:

○ $20 million for transit grants to improve transportation in transit deserts and to expand paratransit.

● In addition to the Executive’s proposed $8.47 billion in capital funding, the Senate adds:

○ $2 billion in bonding authority for the DOT core highway program to support bringing roads to a state of good repair within the 5-year Capital Plan.

○ $50 million in additional support for the Extreme Winter Recovery program, for a total of $150 million.

● Establishes a comprehensive Zero-Emission Buses plan to ensure the transition of school buses, public transit buses, and the state fleet to zero emission buses.

HUMAN SERVICES AND LABOR

● Creates a new childcare subsidy for $4 billion in assistance phased-in over three years.

● Provides $300 million in both SFY 2022-23 and SFY 2023-24 for Unemployment Insurance Fund principal and interest reduction to lessen the burden of federal loan repayments on employers.

● $2.5 million for a Cannabis Workforce Initiative to offer training and education in the cannabis industry.

● Establishes a new scheme to subsidize care for up to 500% of the Federal Poverty Level, provide full reimbursement to providers for children up to five years old, establish bonuses for child care workers, and create a capital development fund and professionally development grants to expand the availability of childcare services.

HOUSING, AGRICULTURE, AND ENVIRONMENT

● Adds $500 million in State funding for the Homeowner Assistance Fund to provide assistance to homeowners with mortgage, property tax, HOA, and Co-op or Condo arrears or who are otherwise at risk of foreclosure.

● Adds $500 million in Capital funding for the New York City Housing Authority.

● Adds $250 million for the Housing Access Voucher Program to assist those who are homeless or who are facing an imminent risk of eviction.

● Adds $150 million in statewide Capital funding for the Housing Our Neighbors with Dignity Program for the conversion of distressed hotel and commercial properties into affordable housing.

● Provides an additional $15 million for the Homeowner Protection Program, for a total of $35 million.

● Provides $400 million to assist individuals in reducing/eliminating their utility arrears.

● Provides an additional $50 million in capital for State parks and recreational sites ($365 million total).

● Requires new construction to be all electric for buildings under seven stories by 2024, and buildings over seven stories by 2027, while directing the State Code Council to adopt updated building energy codes and directing the Department of State and NYSERDA to adopt more efficient appliance standards.

●Increases the Environmental Bond Act by $2 billion ($6 billion total), and ensures at least $4 billion goes towards climate change efforts, including:

○ $1 billion for renewable heating and cooling and weatherization for

low-to-moderate income households (note this can also be promoted as pro-consumer/helping to insulate people from future utility costs).

○ $1 billion for electric school and transit buses and installation of charging infrastructure.

○ $500 million for restoration and flood risk reduction.

● Provides a new framework for the deployment and implementation of $1.5 billion in broadband investments by:

○ Establishing grant programs in underserved communities.

○ Supporting labor standards that will ensure the creation of good jobs in fiber and broadband development.

STRENGTHENING PUBLIC PROTECTION

● Invests $210 million to raise per hour indigent legal service support in the Assigned Counsel 18-B program.

● Adds $40 million to support community safety and restorative justice grant programs that support: a) gun violence prevention programs, gang and crime reduction strategies managed by local governments, and community-based not-for-profit service providers.b) survivors of sexual assault and domestic violence; and c) criminal and civil legal services, alternatives to incarceration, community supervision and re-entry initiatives.

● Provides an additional $25 million for the Victims of Crime Act grant program, for a total of $224 million, to support crime victim assistance, and modifying the Executive proposal to expand benefits for victims of hate crimes and other acts of violence by accepting the Executive proposal to raise the monetary cap to $2,500.

●Creates a new crisis intervention team demonstration program to assist law enforcement officers in responding to crisis situations involving individuals with mental illness and/or substance use disorder.

ECONOMIC DEVELOPMENT AND REVENUE

● Includes $2.2 billion in property tax relief for homeowners this year.

● Allocates an additional $200 million for the Small Business Seed Funding Grant Program, instead of taking money from existing programs, and expands the list of businesses that can apply to this program, as well as allowing those who lost a business due to the Covid-19 pandemic to get some assistance which could be used to restart their businesses.

● Includes $50 million in State funds to help meet New York’s goal of being first in the country to give those most affected by the war on drugs a chance to participate in our new adult cannabis industry.

● Delivers $162 million in personal income tax relief by speeding up the phase in of the Middle Class income tax cuts two years ahead of schedule.

● Increases the Earned Income Tax Credit by 25 percent (30 percent to 37.5 percent) over four years to ensure working New Yorkers get additional assistance.

● Suspends a portion of the State’s taxes on gasoline from May 1 through December 31, 2022 and authorizes a local opt-in to suspend local sales taxes on gasoline sales at local option. The lower prices from suspending these taxes must be passed on to consumers.

Share this Article or Press Release

Newsroom

Go to Newsroom

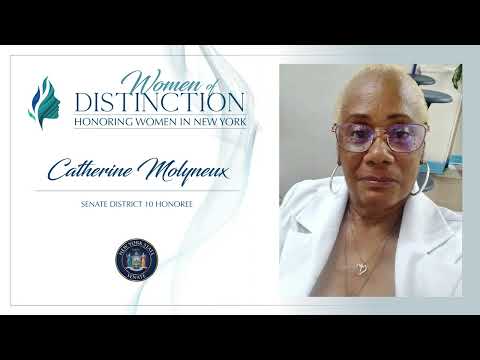

Senator Sanders 2022 Woman of Distinction

August 26, 2022

2022 Queens Carnival Promo Video

August 9, 2022