Senator James Sanders Jr. Says There is More Good than Bad in the 2022-2023 NYS Budget

April 9, 2022

The Legislature passed the new state budget, which is an $8 billion increase over the previous fiscal year and $4 billion more than what Governor Hochul initially proposed for a total of $220.5 billion. Higher-than-expected tax revenues and new federal funding from the various COVID relief packages allowed for the budget increase. The final budget is 3 percent larger than last year’s budget.

The adopted budget includes a suspension of the state's gas tax, an increased investment in child care, $800 million more than the Governor’s $350 million proposal for financially distressed and safety-net hospitals, an alcohol to-go option for bars and restaurants that was utilized in the beginning of the COVID-19 pandemic, and many other provisions.

Senator Sanders said, “This budget is better than most and has many good improvements for the residents and businesses of the 10th Senate District and for all New Yorkers. However, I believe the $600 million in state funding for a new Buffalo Bills Stadium, the most generous taxpayer subsidy of a football stadium in NFL history, is a misplaced priority when many other more worthy needs go unfilled.”

THE GOOD

EDUCATION

- $1.5 billion increase over last year’s for Foundation Aid, the basic funding program for public schools K-12.

- $100 million for mental health grants for school districts and BOCES over two years.

- $125 million in pre-K, with more school districts being eligible as a result. Funding will total $375 million over three years.

- $20 million in capital funding for libraries.

HEALTH

- regarding financially distressed and safety-net hospitals, the Senate fought for and won a significant increase of assistance for these institutions, providing $800 million more than the Executive’s insufficient $350 million proposal. $1.6 billion in health transformation capital grants. This provision will help St. John’s Episcopal Hospital.

- $1.2 billion for frontline health worker bonuses and $7.4 billion for wage increases for home health care aides. Health care workers in Southeast Queens will get a well-deserved bonus and wage increase.

HOUSING

- $800 million to replenish the pool of money available for Emergency Rental Assistance Program (ERAP), in addition to $146 million in recently awarded federal funds. The Budget will also provide $125 million for Landlord Rental Assistance Program (LRAP), as well as $250 million for COVID-era utility arrears. Many of my constituents urgency need this rental and landlord assistance.

- $4.5 billion in spending as part of a total $25 billion five-year Housing Capital Plan, which also includes tax incentives and private investment.

- reappropriation of last year’s $100 million for the Housing Our Neighbors with Dignity Act and adds a new appropriation for $100 million.

HUMAN SERVICES

- $5 billion will be spent over three years for child care, starting with $343 million in stabilization grants that will go out immediately. The eligibility will be 300% of the federal poverty level, or a family of three making $70,000 annually or below.

TAX RELIEF/BUSINESS/ECONOMIC DEVELOPMENT

- no new tax increases

- gas tax suspension from June 1 to the end of the year. about 16 cents per gallon of gas

- property tax relief by increasing STAR benefits around the state. Many will receive hundreds of dollars in relief.

- speeds up the middle-class tax cut currently scheduled to take effect in Tax Year 2025 to Tax Year 2023 instead.

- small business tax cuts.

- tax exemption for student loan forgiveness awards to ensure all state programs are covered.

- extends and enhance the hire-a-vet tax credit for three years. Increases the maximum credit for hiring a disabled veteran full-time or part-time.

- increases the state low-income housing tax credit aggregate cap growth.

- extends the film tax credit for three years and to require applicants to file diversity plans.

- extends the New York Youth Jobs Program tax credit for five years.

- extends the Empire State Apprenticeship tax credit for five years.

- NYC child care business tax credit.

- increases the NYC earned income tax credit.

- restaurant return-to-work credit.

- supplemental payments of the earned income tax credit and the Empire State Child Credit.

- expanded Investment Tax Credit for farmers, as well as a $1,200 credit for farm workforce retention. It will also create an overtime credit to cover farmers’ expenses due to the decrease in the overtime threshold below 60 hours.

HIGHER EDUCATION

- fully reimburse colleges for the TAP Gap, resulting in payments of $48.8 million to SUNY and $59.6 million to CUNY.

PUBLIC PROTECTION

- additional $110 million to public protection agencies to support the following programs; gun violence prevention, legal services, pretrial services, alternatives to incarceration, and discovery reform.

- expands benefits for victims of hate crimes and other acts of violence by raising the monetary cap to $2,500

- $10 million investment in community based programs to combat biased crimes and investing an additional $10 million for Asian American Pacific Islander crisis intervention.

TRANSPORTATION

- $6.7 billion in capital funding for transportation for the first year of a $32.8 billion five-year capital plan.

- The MTA will receive an increase of $757 million and will be held harmless for any potential revenue lost due to the gas tax suspension.

ENVIRONMENT

- authorization for the Environmental Bond Act. Total of $4.2 billion for water and sewer systems against the effects of climate change. Given the flood problems in Southeast Queens, this is very good news.

GENERAL GOVERNMENT

- allows on-premises establishments to sell wine or liquor drinks for take-out or delivery by preventing the sale of full bottles and limiting the authorization to three years.

- requires boards of elections to provide prepaid postage for absentee ballots and ballot applications based on a bill introduced by Senator James Sanders Jr.

CANNABIS/SOCIAL EQUITY

- $50 million investment into a Cannabis Social Equity Fund, which, matched by $150 million in private investment, will finance capital costs for cannabis dispensaries operated by social equity licensees. The Senate successfully negotiated stronger provisions establishing the rights of social equity licensees, oversight, transparency and State control of the private fund.

- allows cannabis businesses to deduct their business expenses.

OTHER

- not in the budget relating to NYC: mayoral control of the school system and a soon-to-expire tax break for housing developers.

THE BAD

- $600 million included for a new Buffalo Bills stadium.

- The budget does not include a ban gas and oil hookups in new buildings starting in 2027, a move that would have made New York the first state to stop adding fossil-fuel burning stoves and heaters and require new buildings to use only electricity.

NEEDS WORK

- tax credit capped at $250 million for small business Covid-related expenses. The budget failed to include an amendment to provide funds for small businesses that went out of business due to COVID so they can restart their business.

- revised bail law directs judges to consider new factors. These factors include whether a defendant is accused of seriously harming another person or has a history of gun use when setting bail. Need the right balance to both protect the rights of the accused while also protecting the safety of the public.

- This Adopted Budget doesn’t include establishing a state public bank and a stock transfer tax, which are two policies that would address income inequality and help distressed communities.

Share this Article or Press Release

Newsroom

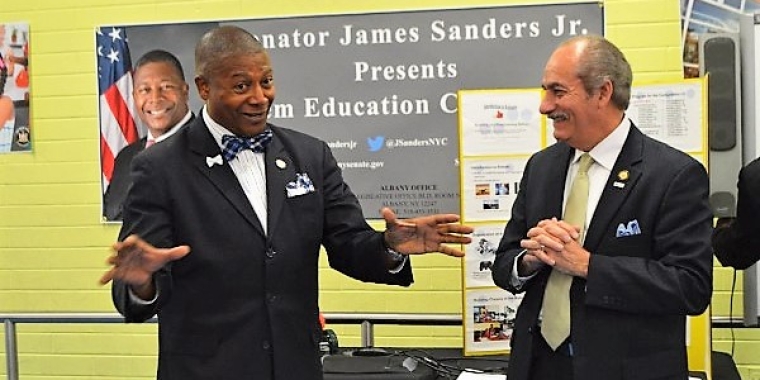

Go to NewsroomSanders Hosts Education & Career Fair

May 6, 2017