Private Student Loan Borrower Protection Bill Passes NYS Senate Consumer Protection Committee

March 2, 2022

-

COMMITTEE:

- Consumer Protection

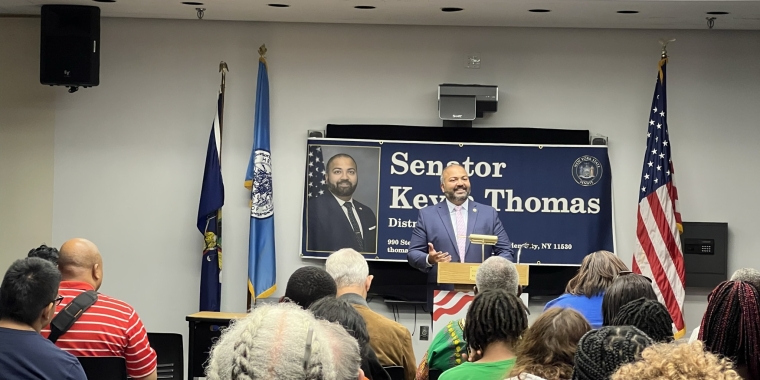

(Albany, NY) — A bill that will expand protections for private student loan borrowers and cosigners (S5136B/A6226) today passed out of the New York Senate Consumer Protection Committee. The legislation, sponsored by Senator Kevin Thomas (D-Levittown), aims to rein in long-standing abuses in the private student loan market and create a bill of rights for cosigners.

Borrowers with private education loans face a wide range of unique challenges when managing student debt. Unlike federal student loans, private student loan lenders routinely require that a student jointly apply for a loan with a cosigner or co-borrower, often a parent or grandparent financing their children’s and grandchildren’s college education. Private loans are often riskier than federal student loans and contain fewer safeguards for borrowers who have trouble managing their monthly payments. When the student borrower cannot make payments, the cosigner is on the hook. Cosigners are subjected to a range of predatory lending tactics, including marketing tactics that promise “cosigner release” after a few years of payments, but end up shackling older adults to a lifetime of debt. Many consumers remain unaware of these risks until it’s too late.

As New York works to recover from the COVID-19 pandemic, these consumers need relief now more than ever. Senator Thomas’ legislation aims to strengthen protections for private student loan borrowers by cracking down on misrepresentation and predatory lending, and would limit the economic exploitation of vulnerable borrowers by ensuring that borrowers and cosigners are properly informed of their rights and responsibilities before taking on debt.

The bill has been reported to the full Senate for consideration.

###

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom

Blue skies, fun rides, songs and waffles

June 9, 2022