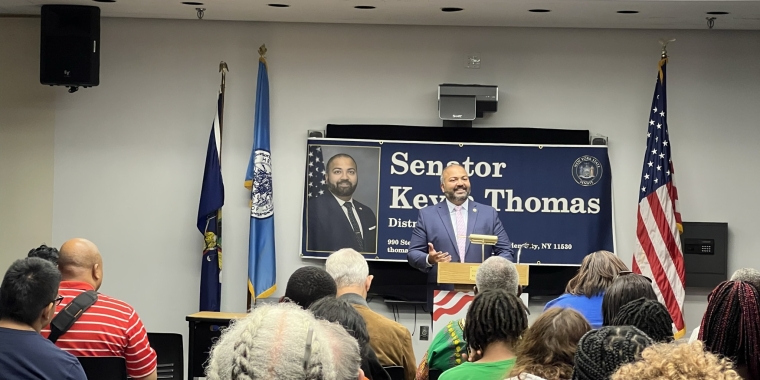

Sen. Thomas’ Legislation Regarding Debt Collection Related to Identity Theft Signed Into Law

June 30, 2022

(Albany, NY) — Earlier today, Governor Hochul signed into law legislation introduced by the Chair of the Committee on Consumer Protection, Senator Kevin Thomas (D-Levittown) regarding debt collection procedures in certain cases of identity theft. Current law compels a victim of identity theft to report such crime to law enforcement in order for collection activities against them to be suspended as further investigation is made into the legitimacy of the debt. This legislation (S.9359/ Thomas) will protect consumers by allowing for an alternative route to report identity theft via the Federal Trade Commission (FTC) and expanding the list of documents that can be used to support statements of identity theft.

Identity theft can occur under different circumstances to many different types of victims. A commonly thought of scenario is strangers stealing personal information but a significant number of identity thefts are committed by people close to the victim. In cases where the victim knows the perpetrator the requirement to report the crime to law enforcement and potentially proceed with criminal charges may not be their wish or safe.

The purpose of this measure is to protect victims of identity theft. Alternative reporting methods through a filing with the FTC ID Theft Victim reporting process and allowing people to share documents showing evidence of identity theft by persons close to the victim does not impede a legitimate debtor's rights, but it can do much to protect those who may not be safe turning to law enforcement to report such activity.

Senator Kevin Thomas said, “Identity theft impacts New Yorkers from all walks of life, and can happen to any of us. Under current law, creditors can only halt collection activities if identity theft victims file a police report documenting the alleged theft, with no acceptable alternatives. Certain victims who may not feel safe turning to law enforcement to report such activity have a harder time proving the legitimacy of their claims.

My legislation expands protections in New York by allowing for more robust reporting options and expanding the list of acceptable documents needed for creditors to cease collection efforts until completion of their review. Affording these alternate ways to properly report identity theft is the right thing to do, and I thank Governor Hochul for protecting consumers by making it easier to access financial relief.”

The New York State Office of Victim Services supported this legislation.

###

Share this Article or Press Release

Newsroom

Go to NewsroomCredit Card Competition Act Takes Swipe At Swipe Fees

December 14, 2022

NY bill would ban TikTok from state-issued devices

December 14, 2022

NY may ban TikTok from government-issued phones over China spying threat

December 12, 2022