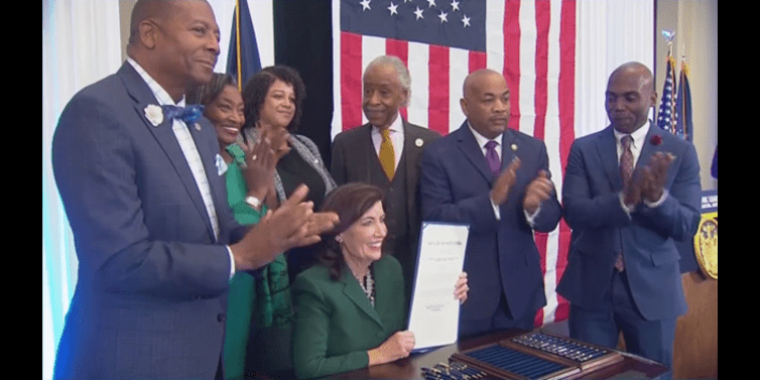

Governor Kathy Hochul Signs the "Foreclosure Abuse Prevention Act" (FAPA)

January 11, 2023

December 31 – Governor Kathy Hochul signed into law a bill that ensures thousands of homeowners will have their rights protected in the foreclosure process throughout New York State. This law restores balance in the foreclosure process since the New York Court of Appeals’ decision in Freedom Mtge. v. Engel in 2021. The new law will prevent manipulative foreclosure practices disproportionately harmful to communities of color.

The bill, known as the "Foreclosure Abuse Prevention Act" (FAPA), was introduced by Senator James Sanders Jr. (D-Queens), Chair of the Senate Banks Committee, and Assemblymember Helene E. Weinstein (D-Brooklyn), Chair of the Assembly Ways and Means Committee. (S.5473-D/SANDERS Same as A.7737-B/Weinstein).

The New York Court of Appeals inadvertently and effectively struck down the statute of limitations in the foreclosure process—elevating this standard to the same standard as murder, which has no statute of limitations. The statute of limitations standard needed to be restored. This law restores the statute of limitation standard as it was since 1965 by bringing back reason and justice to the foreclosure process.

Before this law went into effect, mortgage lenders had the unilateral ability to manipulate and evade the statute of limitations, which no other litigant enjoys in New York. The new law does not disturb New York’s six-year statute of limitations on mortgage foreclosure actions. It simply restores a common-sense principle: no party may unilaterally stop and restart the statute of limitations to revive what would otherwise be a time-barred action. This law ensures the fair application of the statute of limitations.

Senator James Sanders Jr., “I heartily applaud Governor Kathy Hochul for doing the right thing to make sure the foreclosure process in New York is fair to all parties concerned. For most 2 people, a home is a family’s biggest investment and it is where they live their lives. Southeast Queens has particularly been hit hard by home foreclosures over the last decade and it is imperative that we have a fair and just foreclosure process. I deeply thank my Assembly colleague Helene Weinstein for her tremendous efforts, all the numerous elected officials at all levels of government, advocacy groups, and concerned citizens who lobbied hard over this past year to achieve a great purpose.”

Assemblymember Helene E. Weinstein said, “This important law will protect homeowners by preventing mortgage lenders from getting an unfair and unwarranted second bite of the mortgage foreclosure apple. The deck has long been stacked against homeowners due to a highly flawed mortgage foreclosure process, and this bill will go a long way to adding back some fairness to the process. I thank Governor Hochul for signing this bill into law, and I also thank my cosponsor in the Senate, James Sanders, as well as my many colleagues in the Assembly and the Senate who gave strong support to this bill. In addition, I thank the many advocates in the civil legal services community who guided this bill through the legislative process, as well as numerous other elected officials from across New York State who voiced their support. We all stood up for what is right and just, and homeowners are the winners.”

Foreclosure defense attorney, Ivan E. Young, Esq., of the Young Law, PC, and former Counsel to Senator Sanders, said, "I thank Governor Hochul for signing this monumental bill into law that will assist homeowners throughout New York State save their homes from foreclosure. With this new law, the foreclosure pendulum has swung back in favor of homeowners."

Jacob Inwald, Director of Foreclosure Prevention, Legal Services NYC, said, “The enactment of the Foreclosure Abuse Prevention Act will go a long way towards preventing foreclosing lenders from manipulating statutes of limitations at the expense of New York’s struggling low-andmoderate-income homeowners, concentrated in New York’s communities of color, and will ensure that banks and other Wall Street financial institutions are not excused from the longstanding statute of limitations principles that govern any party pursuing a claim in court. Foreclosing lenders who botched thousands of foreclosure actions over the last decade and longer were hardly deserving of the special treatment under the statute of limitations that some appellate decisions had granted them, which had the effect of reviving countless foreclosure cases that were abandoned long ago and casting a pall on title to properties across New York State. With the restoration of the law that the Foreclosure Abuse Prevention Act represents, the law will be restored and foreclosing lenders will have to comply with the same statute of limitations principles that govern anyone pursuing a claim in court.