Tedisco: “Bad Actors” Hochul & Legislative Majority Enrich Hollywood Millionaires While Raising County Property Taxes

May 2, 2023

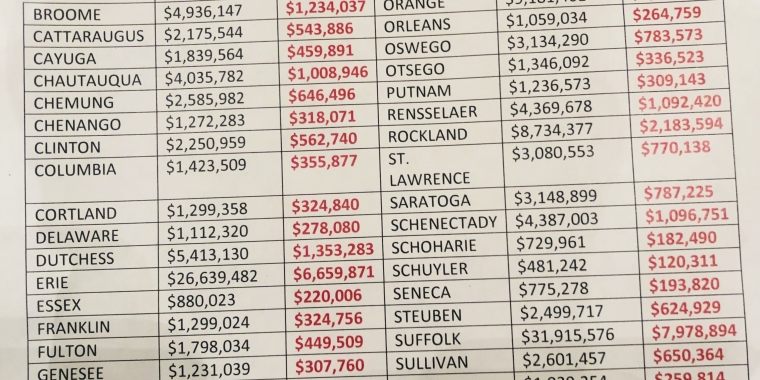

Albany - - Senator Jim Tedisco today blasted Governor Hochul and the Legislative Majorities for advancing a state budget cash grab scheme that would slash Medicaid aid to counties by $774 million which could lead to up to a 10 percent local property tax increase for New Yorkers.

Meanwhile, the Governor and Majorities are passing a state budget that rewards Hollywood film and television moguls who are big donors by boosting the state’s dubious taxpayer-funded “Hollywood Tax Credit” to $700 million.

The budget includes a three-year state claw back of the Federal Medicaid Assistance Percentage aid that’s given by the federal government to the state and has been passed through to county governments since 2015. Counties have used this aid to keep property taxes down and stay within the 2 percent property tax cap. The New York State Association of Counties estimates this cut will send local property taxes skyrocketing in New York by 5 to 10 percent.

“Talk about bad actors, the Governor and Legislative Majorities are behaving like they’re in a slasher film with a diabolical cash grab scheme to eviscerate state aid to counties while giving sweetheart deals to super-wealthy Hollywood studios and moguls. This budget is the ‘Nightmare on State Street’ for overburdened New Yorkers who now face higher property taxes because of the Governor and Majority’s cash grab,” said Senator Jim Tedisco.

“This budget certainly makes New York more affordable for Hollywood studios so they can exploit the state on the taxpayer’s dime but does nothing to reverse the fact that our beautiful state is #1 for outmigration of ordinary citizens who can no longer afford to live and work here any longer,” said Senator Tedisco.

Share this Article or Press Release

Newsroom

Go to NewsroomTedisco & Jordan: “Cuomo Lied and New Yorkers Paid and Died”

February 15, 2021

Tedisco: Cuomo’s Nursing Home Data Release Still Incomplete

February 11, 2021