DCWP coming to Addabbo's office for information free tax prep event this April

Senator Joseph P. Addabbo, Jr.

March 27, 2023

Ahead of tax deadline day on Tuesday, April 18, State Senator Joseph P. Addabbo, Jr. is bringing representatives from the New York City Department of Consumer and Worker Protection (DCWP) — including the Commissioner, Vilda Vera Mayuga — to his Middle Village office to inform residents about NYC Free Tax Prep services and other programs.

On Wednesday, April 5, DCWP and Commissioner Mayuga will be at Addabbo’s Middle Village office, located at 66-85 73rd Place, from 1 p.m. to 2 p.m. to answer questions and assist people with accessing NYC Free Tax Prep, as well as speaking about other important programs to help residents get the most back from their taxes.

Families with dependents who earned $80,000 or less and individuals who earned $56,000 or less in 2022 can use this service to file for free with an IRS certified VITA/TCE volunteer preparer and avoid having to pay expensive tax preparation fees. Anyone who lives or works in New York City and meets the income requirements is eligible to use NYC Free Tax Prep.

“In these tight economic times it is so important for people to get the most out of their taxes. Eliminating any tax preparer fees is a good start, so these programs offered by DCWP allow NYC residents who meet the income threshold to file their taxes for free,” Addabbo said. “With new free tax prep services for self-employed New Yorkers and financial counseling at the NYC Financial Empowerment Centers, this informational event has something for everyone. I want to thank DCWP and Commissioner Mayuga for coming to my office to get this information out to my constituents.”

NYC Free Tax Prep offers multiple options to file for free, including in-person, drop-off, virtual and online services.

A checklist of what documents New Yorkers need to bring with them to file and multilingual information about the services are available online.

Documents needed in order to file your taxes for free with the NYC Free Tax Prep program include:

- Government-issued photo ID (includes IDNYC) and Social Security cards or Individual Taxpayer Identification Numbers (ITIN). ITIN determination letters (original, copy, or electronic document) and birth dates for you, your spouse, and your dependents.

- Proof of income including Form W-2 (wages from each job), Form 1099-INT (interest), Form 1099-DIV (dividends), Form 1099-R (retirement plans), Form W-2G (gambling winnings), and any other forms that may pertain to your specific situation.

- Your banking information so you can receive your return via direct deposit.

“Since 2008, NYC Free Tax Prep has helped New Yorkers file more than 1.4 million tax returns, saving them more than $216 million in potential filing fees,” said Department of Consumer and Worker Protection Commissioner (DCWP) Vilda Vera Mayuga. “This year, we’re helping more filers with the newly enhanced NYC Earned Income Tax Credit (EITC) and our expanded NYC Free Tax Prep services for self-employed New Yorkers. Thank you to Senator Addabbo, and our amazing tax prep partners for working to help New Yorkers keep their hard-earned money.” DCWP will also be announcing the new NYC Free Tax Prep service for self-employed New Yorkers. If you work for yourself, you need to file taxes annually and make estimated tax payments quarterly.

Another program they will be mentioning is the NYC Financial Empowerment Centers which provide free one-on-one professional financial counseling and coaching to support New Yorkers in reaching their financial goals.

For more information on how to file your taxes for free through the NYC Free Tax Prep program, nyc.gov/TaxPrep. To learn more about the NYC Financial Empowerment Centers visit nyc.gov/TalkMoney.

Share this Article or Press Release

Newsroom

Go to NewsroomSearch for STAR check delivery status

October 1, 2017

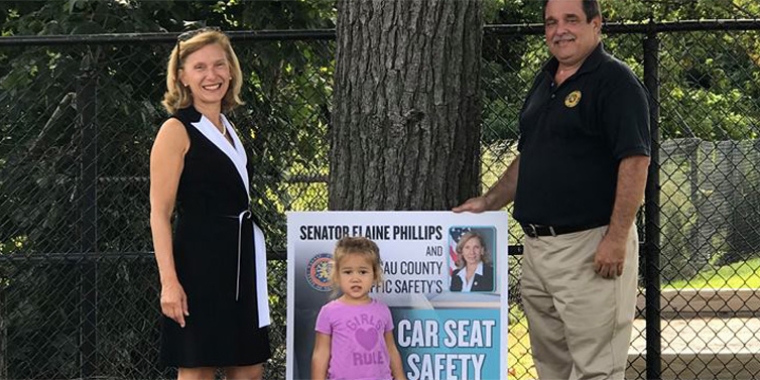

Senator Phillips Hosts Free Car Seat Safety Check

September 29, 2017

Senator Elaine Phillips Meets With The Carle Place Seniors

September 29, 2017