Tedisco and Buttenschon Announce New Bi-Partisan Bill to Help NY Farmers Provide Farm Workers with Much-Needed Affordable Housing

March 21, 2024

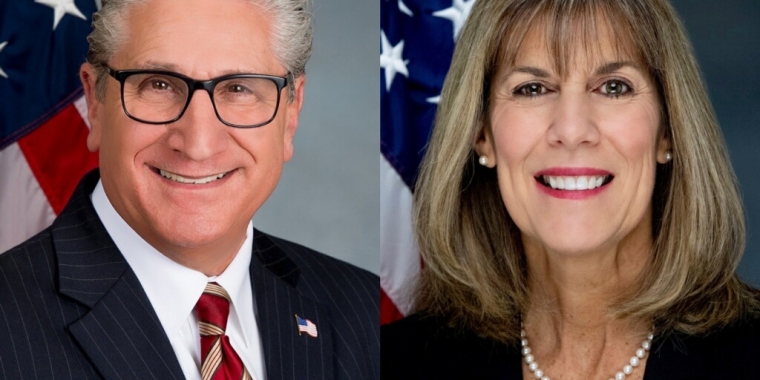

(L - R) M. of A. Aileen Gunther, Natally Batiston, NYFB Mgr. - Saratoga County, M. of A. Marianne Buttenschon, Paul Molesky, NYFB Dist. 8 Rep., Senator Tedisco, Kevin Bowman - Bowman Orchards, Jeff Williams, Public Policy Dir., Sen. George Borrello

Senator Tedisco and Assemblymember Buttenschon’s bill provides a 20 percent tax credit for family farmers to address affordable housing crisis and build housing for their farmworkers

Senator Jim Tedisco (R,C-Ballston Lake) and Assemblymember Marianne Buttenschon (D-Utica/Rome) today joined with family farmers and the New York State Farm Bureau to announce new bi-partisan legislation they are sponsoring to address New York’s affordable housing crisis and help save family farms in the state.

Tedisco and Buttenschon’s bill (S.8804) would expand the state’s 20 percent Investment Tax Credit (ITC) for farmers to include the cost of construction of housing for farm workers.

While New York State businesses that make investments in buildings, machinery, or equipment currently receive the ITC, the tax code is silent on this credit being applied to buildings, machinery, and equipment dedicated to the construction of residential housing for farm workers.

Tedisco and Buttenschon’s legislation addresses this by ensuring over-burdened family farmers continue to have affordable housing for the farm workers who are essential to the success of the state’s agricultural industry.

The most recent agriculture census by the USDA in 2022 revealed cause for concern about the state of farming in New York State and the urgent need to support family farms. According to the New York State Farm Bureau:

Between 2017 and 2022, NY lost 2,800 family farms – that is a 9 percent drop from the previous census and the steepest decline in the past three decades.

New York also lost 364,000 acres of farmland over the past five years.

A significant portion of the decline is in dairy farming, the largest commodity value in New York State. New York saw a decrease of nearly 1,900 dairy farms,

Every production expense saw a rise, from fertilizer and fuel to seed and lease prices. The biggest increase in production expenses is labor, which saw an astounding 41 percent jump in five years.

New York farms employ 56,678 people. All sectors of agriculture, including processing, are responsible for nearly 200,000 jobs in New York State.

Family farms are not only vital to the economic vitality of the state, but also to the food security of New York by producing a portion of the food residents need close to home.

“Our family farms are a big part of New York’s economy, and the state needs to do more to save them. This bi-partisan legislation provides a 20 percent tax credit to help our family farmers ensure they continue to have the labor force needed to help them grow and it helps address our state’s urgent affordable housing crisis by providing farmers with relief for the construction of new affordable housing for farm workers,” said Senator Jim Tedisco.

“Housing is a concern for all employers, and our farmers are not exempted. To provide optimal housing for our farm employees should be a priority. This tax credit will assist our farmers with much needed local housing,” said Assemblymember Marianne Buttenschon.

“Farmworkers are essential to our family farms and food system. Many receive free housing as an employment benefit, and as labor needs expand, the need for additional housing does too. New York Farm Bureau is appreciative of Sen. Tedisco and Assemblywoman Buttenschon for introducing legislation that will allow for the construction of employee housing to be included in the refundable Investment Tax Credit for agriculture that passed last year. This important budget bill will incentivize new housing and improve the quality of life for the men and women who help to put food on all of our tables,” said David Fisher, New York Farm Bureau President.

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomTedisco & Jordan: “Cuomo Lied and New Yorkers Paid and Died”

February 15, 2021

Tedisco: Cuomo’s Nursing Home Data Release Still Incomplete

February 11, 2021