Senator Flanagan Announces Homeowner Rebate Plan

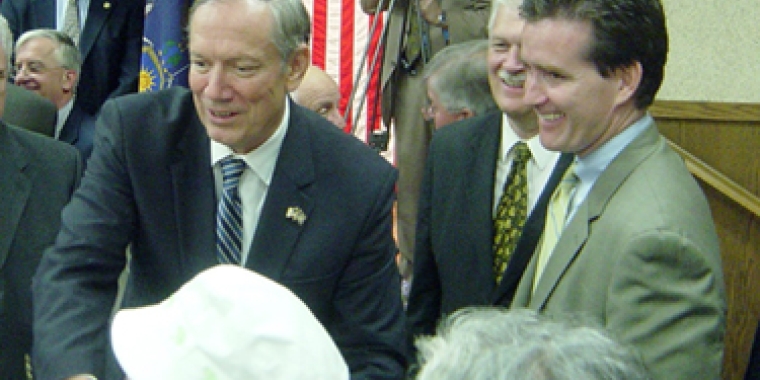

Senator John J. Flanagan (2nd Senate District) joined Governor George E. Pataki at the Eugene Cannataro Senior Center in Smithtown as the Governor signed the property tax relief rebate program into law. The program will deliver an estimated $210 million in direct property tax relief this year to homeowners across Long Island.

The rebate plan, which originated in the New York State Senate, will deliver rebate checks directly to homeowners beginning this October. The program will deliver over $2.7 billion in tax savings to New York homeowners over the next three years.

"Tax relief for Long Island homeowners has been my main goal since the beginning of the year. Homeowners on Long Island are struggling with their property tax burden and this will provide long overdue relief," stated Senator Flanagan. "I applaud Governor Pataki for signing this critically important tax relief measure into law for all Long Island homeowners."

The first phase of the homeowner tax relief will deliver rebate checks to Long Island homeowners who already are enrolled in the New York State School Tax Relief (STAR)program. These taxpayers, whether they receive the Enhanced or Basic STAR exemption, will receive a check in the amount of 30% of their current STAR benefit around October.

According to Governor Pataki's office, Suffolk County residents who receive the Basic STAR exemption will receive an average of $231 per household. For those who qualify for the Enhanced STAR exemption, the amount of the check would average approximately $375.

For Long Island homeowners who are not currently enrolled in the STAR program, there will be an opportunity beginning October 1st to apply for the rebate program. By applying for the program, these homeowners will receive the rebate check in a couple of months from that date.

Those homeowners who apply for the rebate in this manner would receive the same amount of rebate as those who are already registered for the STAR program. Due to the regulations of the STAR program, applying for this rebate will not automatically enroll homeowners into the STAR program.

A separate application for the STAR program is needed regardless of application to the property tax rebate plan.

"By providing rebate checks directly to homeowners, we are taking another important step in providing New Yorkers significant relief from their school property taxes," Governor Pataki said. "Our STAR program has been a tremendous success in helping seniors and families, and it’s vital that we continue to take steps to reduce the local tax burden and allow New Yorkers to spend and save more of their hard-earned money."

To ensure that this rebate plan continues in the future, the program would switch to a personal income tax credit program if a future governor decides not to fund the program through a proposed budget. The credit would be available to all who own a home and would be equal to the same 30% of the STAR program that the rebate program will deliver.

CLICK HERE for more information about the STAR program.

"Since this plan provides greater tax relief to areas with the highest property tax burden, this is a plan that delivers in a targeted and realistic manner. On Long Island, where many homeowners are being forced to make financial decisions based on their property tax burden, that will mean direct relief to help our residents stay where they want and live the life they choose," concluded Senator Flanagan.

TO SEND AN E-MAIL TO SENATOR FLANAGAN, PLEASE CLICK HERE.

IF YOU WOULD LIKE TO RECEIVE REGULAR UPDATES FROM SENATOR FLANAGAN, PLEASE CLICK HERE.