Senator Dilan Encourages Individuals To Utilize The Earned Income Tax Credit

State Senator Martin Malavé Dilan announced a tax saving opportunity for New Yorkers known as the Earned Income Tax Credit (EITC). The EITC is a tax benefit offered by the federal government that is meant to assist low- and middle-income working families.

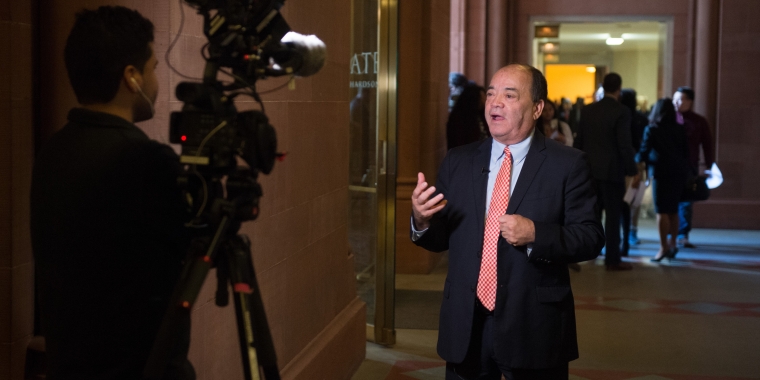

“This tax benefit is a chance for the hardest working families right here in New York to put significant money back into their pockets. I encourage everyone eligible for this credit to take advantage of it,” Senator Dilan said.

The EITC is available to married workers earning less than $34,001 with one qualifying child, or those earning less than $38,348 with two or more qualifying children. Also, individuals between the ages of 25 and 64 who do not have children and earn less than $12,120 may qualify. Those married with no children must earn less than $14,120 to be eligible. In 2006, over 21 million low- and moderate-income New Yorkers were able to claim Earned Income Tax Credits that were worth more than $38 billion.

In addition, New York State offers eligible residents its own tax credit on top of the federal EITC. This state benefit is equal to 30% of the federal EITC for the 2006 tax year. Those eligible can receive substantial savings by applying for both the federal and state tax benefits.

“I have been consistently working hard in the Senate to improve the lives of our working families. This tax credit is something that will help families by providing them with some well-deserved tax breaks. It is my hope we can consistently provide ways for families to save money and provide a better life for their children,” Senator Dilan said.

Individuals interested in receiving more information aboutEITC eligibilitymay obtain an informational brochure by either calling Senator Dilan’s office at (718) 573-1726 or stopping by 786 Knickerbocker Avenue in Brooklyn.