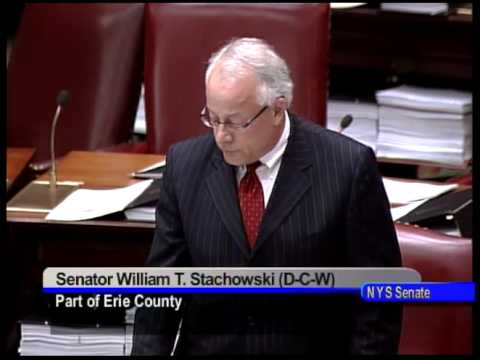

Senator Stachowski Calls For Measure To Advance Historic Rehabilitation

March 9, 2010

Bill To Provide Tax Credits On Commercial Properties

Senator William T. Stachowski (D-C, Lake View), Chairman of the Senate Committee on Commerce, Economic Development and Small Business, announced he is a lead sponsor of legislation (S.7042) introduced today in the State Senate that would expand provisions in the Historic Rehabilitation Tax Credit (HRTC) program and clear the way for several major development projects in Upstate New York to begin.

“This legislation will strengthen current law affecting the rehabilitation of historic properties,” said Senator Stachowski. “By further extending the historic rehabilitation tax credit program so that commercial properties can be more fully included, we will help sustain the unique historical and cultural importance of many buildings throughout the state. In addition to protecting the historic heritage of our hometowns, many jobs will be created as a result of this legislation greatly impacting our local economy.”

Amendments to the current law expand what the program can accomplish by aligning the tax credits to address the specific needs of larger commercial projects so that it can accomplish its full potential and stimulate the highest levels of economic development across Upstate. New provisions would put New York State’s tax credit program on par with successful programs in other states.

The new legislation grants project developers the ability to allocate the state credit within a partnership or LLC different from the federal tax credit, and the ability to apply the credit against the bank and insurance tax.

“There are several hundreds of millions of dollars in economic development projects statewide on hold just waiting for this change in the law including the rehabilitation of the former AM&A department store in Buffalo,” said Senator Stachowski. “When this legislation is adopted, this and other projects will be able to quickly move forward creating hundreds of new jobs and millions in Main Street reinvestment across the state.”

The bill was sent to the Assembly.