New York State Budget Update

Hugh T. Farley

March 17, 2011

-

ISSUE:

- Budget

State Senator Hugh T. Farley (R, C, I - Schenectady) reported that earlier this week he and his colleagues in the New York State Senate passed the Senate’s budget resolution - - a fiscally sound plan that reduces spending, rejects tax increases and makes responsible investments in New York’s future.

The Senate budget closes a $10 billion budget deficit without raising taxes, and allows the PIT surcharge to sunset as scheduled so small businesses and others can get back to creating jobs for workers.

Coming in at approximately $132.5 billion, the Senate budget spends slightly less than the Executive Budget and stabilizes the State’s finances this year and in future years. Senate Republicans accept the Governor’s recommended caps on future Medicaid and education spending, which is in line with previous Senate Republican calls for passage of a State spending cap.

The Senate budget makes minor school aid restorations ($280 million) which ensure greater equity for every region of the State. These minor restorations are mainly targeted to Upstate rural districts which are the most reliant on State aid and were most impacted by the Governor's budget.

The Senate accepts 95 percent of the $2.9 billion in reductions and reforms recommended of the Governor's Medicaid Redesign Team and authorizes counties to eliminate optional Medicaid services - - building on the Senate Republicans’ commitment to reducing the cost of the Medicaid program to ease the burden on state and local taxpayers.

The Senate budget includes the Governor’s proposed Power for Jobs program bill to address the pressing need to help businesses create jobs, especially Upstate. The Senate passed the Governor’s program bill earlier this year.

The Senate budget eliminates $296 million in cost shifts to local governments that could have led to property tax increases at the local level. While Senate Republicans are committed to delivering real and lasting mandate relief to local governments and school districts who are dealing with soaring costs which are sometimes out of their control, the State must also mitigate cost shifts that impact their budgets and local taxes.

The budget includes a modified version of LIFO supported by Mayor Bloomberg that continues our efforts to reach a three-way education reform solution so that every student has the best possible teacher leading his or her classroom.

On prisons, the Senate Budget includes alternative language to the Governor’s Executive Order to ensure that any closures are done in a way that minimizes the impact on the local community. It creates a Prison Efficiency Task Force that would recommend cost-saving strategies the Department of Correction and identify minimum and medium security facilities to close. The proposal sets forth criteria for the task force to consider, including marketability, value, economic impact, cost, workforce productivity and impact on unemployment.

Senate Republicans also advance various budget reforms, including GAAP accounting, performance budgeting and creation of an independent budget office, and remain committed to open, public conference committees to finalize an enacted budget before the April 1 deadline.

Share this Article or Press Release

Newsroom

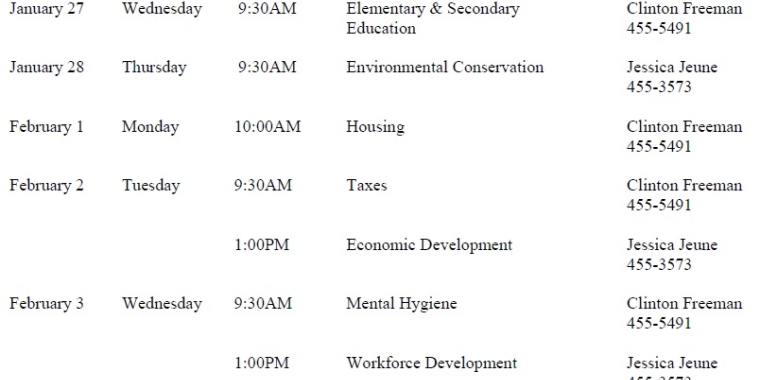

Go to NewsroomLegislature Announces Joint Budget Hearing Schedule

January 12, 2016

Senator Farley Encourages People to Donate Blood

January 8, 2016

Reporting on Recent Developments in Education Requirements

December 11, 2015

Never Forget Pearl Harbor

December 7, 2015